📰 DMK AI Summary Pump.fun, a popular Solana-based memecoin launchpad, is revamping its creator fee system to address skewed incentives. The existing model encouraged token creation over liquidity, impacting market behavior. The platform is introducing a new fee-sharing system to allocate fees across multiple wallets and improve user experience. 💬 DMK Insight The overhaul of Pump.fun’s creator fee system is crucial for sustainable market behavior. By shifting focus from token minting to liquidity building, the platform aims to foster healthier trading environments and encourage active participation from creators and traders. This update reflects a commitment to creating more balanced incentives within the memecoin market. 📊 Market Content The initiative by Pump.fun to revamp its creator fee system could have broader implications for the Solana memecoin ecosystem. By promoting a more sustainable approach to token creation and liquidity provision, this move may influence how other launchpads and projects structure their fee models. Traders and investors in the memecoin space will likely monitor these developments for potential market impacts.

A16z raises $15B, says crypto a 'key' to America winning next 100 years

Crypto remains a key technology for maintaining America’s technological edge, according to a16z, which has raised another $15 billion to back American-aligned tech investments. 🔗 Source 💡 DMK Insight a16z’s $15 billion raise signals strong institutional confidence in crypto’s role in tech innovation. This funding isn’t just a cash influx; it reflects a broader trend where major players see crypto as integral to maintaining competitive advantages. For traders, this could mean increased volatility and opportunities in related assets, especially those tied to American tech. Keep an eye on how this funding influences market sentiment and whether it leads to bullish movements in major cryptocurrencies. If you’re trading, consider focusing on altcoins that align with these tech investments, as they might see a spike in interest and liquidity. On the flip side, while institutional backing is promising, it’s worth questioning whether this will translate into immediate price action or if the market will take time to digest this news. Watch for key resistance levels in Bitcoin and Ethereum, as a break above those could signal a broader rally fueled by this institutional confidence. 📮 Takeaway Monitor Bitcoin and Ethereum for resistance breaks; a16z’s funding could drive bullish sentiment in tech-aligned crypto assets.

Pump.fun says creator fees ‘may have skewed’ incentives, plans revamp

Pump.fun is introducing a new creator fee sharing system that lets teams and CTO admins split fees across up to 10 wallets, transfer coin ownership and revoke update authority. 🔗 Source 💡 DMK Insight Pump.fun’s new fee-sharing system could reshape how creators manage revenue streams. By allowing teams to split fees across multiple wallets, this move not only enhances transparency but also incentivizes collaboration among creators. For traders, this could mean increased activity in the Pump.fun ecosystem, potentially driving up demand for its native tokens. If creators can more effectively manage their earnings, we might see a surge in new projects launching on the platform, which could ripple through related assets in the crypto space. Keep an eye on how this impacts trading volumes and price movements in the short term, especially if we see a spike in creator-led initiatives. However, it’s worth questioning whether this will lead to a dilution of token value if too many projects flood the market. Traders should monitor key metrics like transaction volumes and wallet activity to gauge the real impact of this change. Watch for any price reactions in the coming weeks as the community adapts to this new structure. 📮 Takeaway Monitor transaction volumes and wallet activity on Pump.fun to gauge the impact of the new fee-sharing system on token demand and price movements.

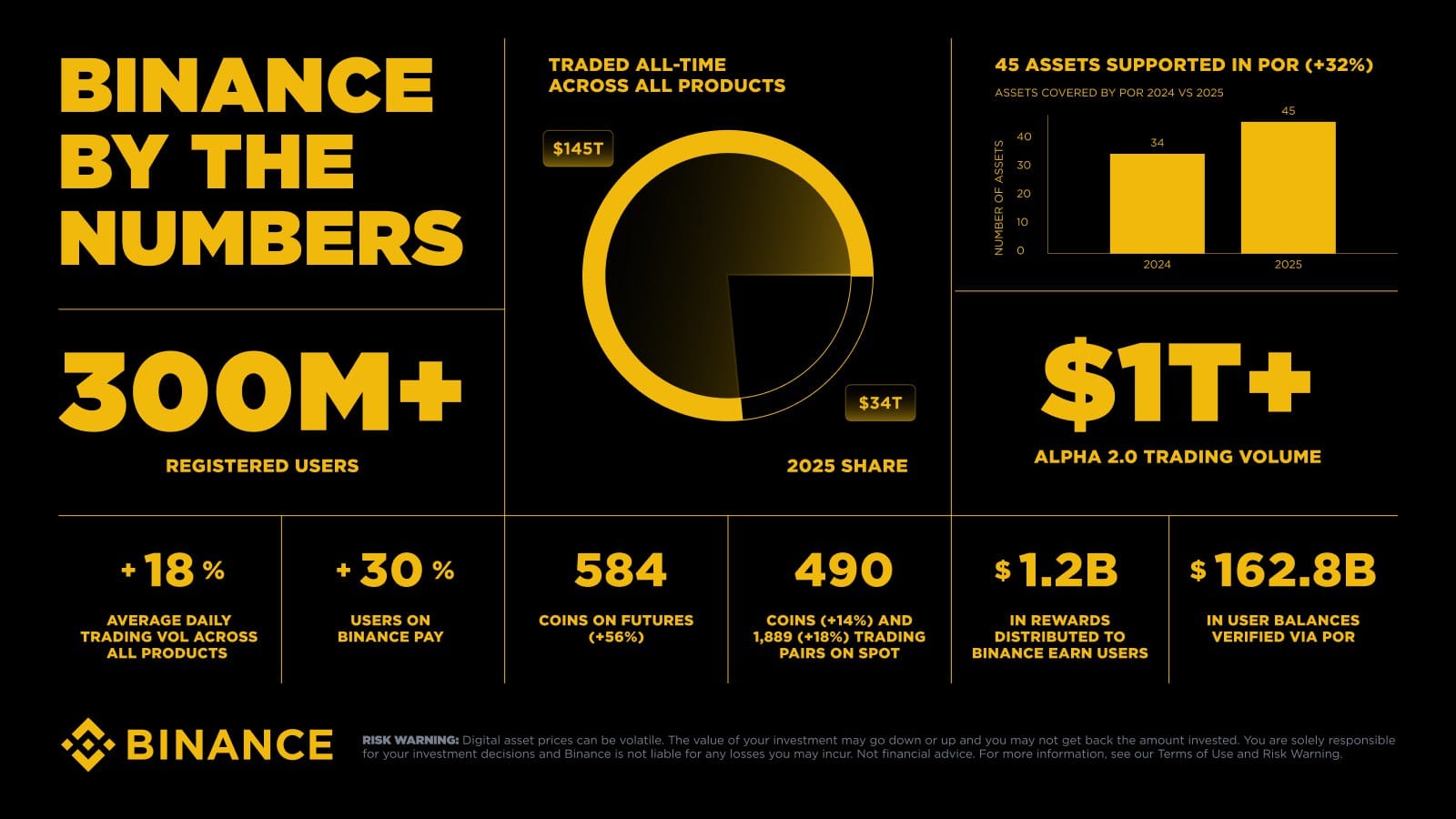

Binance’s State of the Blockchain 2025: Record $34 Trillion Volume Signals New Era for Crypto Airdrops

Binance has released its comprehensive State of the Blockchain 2025 report, revealing unprecedented growth metrics that reshape our understanding of cryptocurrency’s institutional adoption and retail participation. With $34 trillion in total trading volume, $7.1 trillion in spot markets alone, and institutional trading volume surging 21% year-over-year, the world’s largest exchange is operating at a scale … Read more Der Beitrag Binance’s State of the Blockchain 2025: Record $34 Trillion Volume Signals New Era for Crypto Airdrops erschien zuerst auf airdrops.io. 🔗 Source 💡 DMK Insight Binance’s latest report shows a staggering $34 trillion in trading volume, signaling a major shift in crypto adoption. This growth isn’t just a number; it reflects a broader trend where institutional players are increasingly entering the space, with a 21% year-over-year rise in institutional trading volume. For traders, this could mean heightened volatility and liquidity, especially in spot markets where $7.1 trillion was traded. Look for potential breakout patterns in major cryptocurrencies as this influx of capital could drive prices higher. However, it’s worth questioning whether this growth is sustainable or if it’s a bubble waiting to burst. Keep an eye on key resistance levels in Bitcoin and Ethereum, as they may react to this institutional interest. Monitoring the sentiment in the derivatives market could also provide insights into how retail traders are positioning themselves in response to these developments. 📮 Takeaway Watch for breakout patterns in Bitcoin and Ethereum as institutional interest surges, particularly if trading volume continues to rise significantly.

Ripple scores UK regulatory approval via local subsidiary

Ripple’s UK subsidiary gained regulatory approval as an Electronic Money Institution to provide payment services, but faces limits on certain crypto activities. 🔗 Source 💡 DMK Insight Ripple’s UK subsidiary just scored a regulatory win, but there’s a catch: limited crypto activities. For traders, this approval is a double-edged sword. On one hand, it legitimizes Ripple’s operations in the UK, potentially boosting confidence among institutional investors. On the other hand, the restrictions on crypto activities could hinder growth and innovation in a rapidly evolving market. This could lead to volatility in Ripple’s price as traders react to the news. Keep an eye on how this impacts XRP’s trading volume and price action in the coming days. If XRP breaks below key support levels, it might signal deeper bearish sentiment. Here’s the thing: while mainstream coverage may hype the approval, the limitations could stifle Ripple’s competitive edge against other crypto payment solutions. Watch for any updates on regulatory changes or partnerships that could shift this narrative. The next few weeks will be crucial for assessing Ripple’s market position and its ability to adapt to these constraints. 📮 Takeaway Monitor XRP closely; if it drops below key support levels, it could indicate deeper bearish sentiment amid regulatory constraints.

US lawmaker's bill would ban politically related prediction bets after Maduro wager

The bill came after a Polymarket user netted more than $400,000 on a contract related to the removal of then-Venezuelan President Nicolás Maduro, fueling concerns about insider trading. 🔗 Source 💡 DMK Insight The recent Polymarket payout raises serious questions about market integrity and insider trading risks. With a user netting over $400,000 on a contract tied to Maduro’s potential removal, traders should be wary of how this could influence sentiment in political prediction markets. Such high-stakes payouts can attract scrutiny from regulators, potentially leading to tighter restrictions on prediction markets. If insider trading allegations gain traction, it could create volatility not just in Polymarket but also in related assets like cryptocurrencies that thrive on speculative trading. Keep an eye on how this situation develops, as any regulatory response could shift market dynamics significantly. For traders, monitoring the volume and price movements in prediction markets will be crucial. If you see a spike in trading activity or unusual price swings, it might signal a broader market reaction to these allegations. Also, watch for any official statements from Polymarket or regulatory bodies in the coming days, as they could provide clarity or further uncertainty. 📮 Takeaway Watch for regulatory responses to the Polymarket payout; volatility in prediction markets could impact related assets significantly.

CLARITY Act hinges on bipartisan support, and here are the numbers: Analyst

The crypto market structure bill is unlikely to come up for a second vote in 2026 if it fails to pass in a vote next week, analyst Alex Thorn said. 🔗 Source 💡 DMK Insight The potential failure of the crypto market structure bill next week could trigger significant volatility in crypto assets. If this legislation doesn’t pass, it could lead to increased uncertainty among investors, especially as we approach the end of the year. Traders should be aware that regulatory clarity is crucial for institutional participation, and without it, we might see a retreat from riskier assets. Watch for key price levels in major cryptocurrencies; if Bitcoin breaks below its recent support, it could signal a broader sell-off. Conversely, if the bill passes, expect a bullish sentiment to drive prices higher, particularly in altcoins that have been lagging. Keep an eye on market sentiment indicators and trading volumes as we approach the vote, as they could provide insights into how traders are positioning themselves ahead of this critical decision. 📮 Takeaway Watch Bitcoin’s support levels closely; a break could lead to a broader market sell-off if the crypto bill fails next week.

US lawmakers demand ethics safeguards for market structure bill: Report

Democratic leaders on key committees considering crypto market structure legislation are reportedly drawing a line in the sand over elected officials profiting off the industry. 🔗 Source 💡 DMK Insight Democratic leaders are pushing back against elected officials profiting from crypto, and here’s why that matters: This move signals a potential shift in regulatory sentiment that could impact market stability. If legislation restricts officials from capitalizing on crypto, it could lead to increased scrutiny and transparency, which may either bolster or undermine investor confidence. Traders should keep an eye on how this plays out, as it could affect sentiment across the broader market, especially in altcoins that thrive on speculative trading. If the legislation gains traction, we might see a ripple effect impacting not just crypto but also traditional financial markets, as investors reassess risk in light of potential regulatory changes. On the flip side, if this legislation fails to pass, it could embolden more speculative behavior in the crypto space, leading to volatility. Watch for key developments in the coming weeks, particularly any announcements from congressional hearings or committee votes that could provide clarity on the direction of crypto regulation. 📮 Takeaway Monitor upcoming congressional hearings for potential regulatory shifts that could impact market sentiment and trading strategies in crypto and related assets.

Colombia advances crypto tax rules as global reporting standards take shape

New rules from Colombia’s tax authority require crypto service providers to collect and share user and transaction data. 🔗 Source 💡 DMK Insight Colombia’s new tax rules for crypto could shake up local trading dynamics. By mandating crypto service providers to collect and share user data, the government is tightening its grip on the market. This could lead to increased compliance costs for exchanges and potentially drive some users to less regulated platforms. Traders should be aware that this move may create volatility in Colombian crypto assets as participants react to the new compliance landscape. Additionally, it could set a precedent for other countries in the region, influencing broader regulatory trends. Watch for how local exchanges adapt and whether this leads to a shift in trading volumes or user behavior. Keep an eye on major Colombian cryptocurrencies for any price fluctuations as the market digests this news. 📮 Takeaway Monitor Colombian crypto assets closely for volatility as new tax rules could impact trading behavior and compliance costs.

Nasdaq Futures Today: The Order Flow Behind Today’s Moves

For InvestingLive.com Traders and Investors Date: January 9, 2026 Session: Pre-Market / Early US Session Asset: Nasdaq-100 Futures (NQ)Nasdaq Futures Today: From Apparent Weakness to Structural StrengthEarlier in the session, Nasdaq futures appeared vulnerable. Price briefly pushed below recent value, creating the impression that a bearish breakdown might be developing. That initial read, however, proved misleading.While the headline chart now shows a straightforward rally, the more important story sits beneath the surface. Order flow revealed a sequence of events that pointed to institutional defense, ineffective selling, and a gradual transition from rotational trade into a developing trend.This shift did not happen suddenly. It unfolded step by step, and understanding that process matters for positioning and risk management.1. The Turning Point in Nasdaq So Far Today: A Failed Test Near 25,650The most important moment of the session came during the dip below yesterday’s value area.Price moved under the 25,660 zone and appeared set to test the well-advertised liquidity level near 25,650. That test never happened.Instead, selling pressure was absorbed above the level. Buyers stepped in early, preventing price from completing the expected downside auction.In order flow terms, this is a meaningful signal. When price approaches an obvious downside target and fails to trade there, it often reflects impatient demand. Strong participants were not waiting for cheaper prices. They were willing to transact earlier than expected.That behavior left late sellers exposed and set the stage for a reversal in control.2. Nasdaq Bulls Reclaiming Control: VWAP and Value Area HighFollowing the failed downside attempt, market behavior shifted decisively.The move back through VWAP was not a slow grind. It was supported by expanding volume, consistent with short covering layered on top of fresh directional buying.The more important confirmation came with the reclaim of 25,698, yesterday’s Value Area High and a key reference throughout the session.From an order flow perspective, this marked a clear change in narrative.Prior resistance transitioned into supportSelling attempts above that level lost effectivenessValue stopped rotating lower and began migrating higherAt that point, the market moved away from balance and into continuation.3. The Current Phase in Nasdaq Futures: Controlled, Stair-Step ContinuationBefore we dive into what is happening on Nasdaq futures today, let’s look at the 4 hr chart within the last weeks, for an overview of where price is at.After the initial squeeze higher, Nasdaq futures transitioned into a healthier structure.Rather than accelerating vertically, price has been advancing in a measured, stair-step fashion. On lower timeframes, pullbacks have been shallow and quickly absorbed. Sellers remain active, but their participation has not resulted in sustained downside progress.This type of ineffective selling is commonly seen in durable trends. Importantly, value has continued to build higher alongside price, suggesting acceptance of higher prices rather than rejection.This is not emotional momentum. It is controlled acceptance.Key Levels and Forward Scenarios for Nasdaq Futures TodayNasdaq futures are now pressing through the 25,750 area and approaching a meaningful cluster of overhead references.Primary Upside Magnet: 25,780 to 25,790 This zone includes a prior Point of Control and a key structural reference from earlier in the week.What matters from here is behavior, not direction alone. Strong trends often pause or consolidate near composite levels. The focus shifts to whether selling pressure becomes effective or continues to be absorbed.Bullish structure remains intact while:Price holds above the prior breakout zone near 25,720Pullbacks remain shallow and value continues to migrate higherA sustained acceptance back below those levels would suggest a return to balance. At this stage, the evidence does not support that outcome.Nasdaq Trader TakeawayTradersand investors, while the above looks at today’s order flow and price action, keep in mind the The Big Picture: Experts Disagree on the “Jobs Report” The market is preparing for the release of the Non-Farm Payrolls (NFP) report, which tells us how many jobs the US economy added last month. Right now, there is no clear agreement—different banks are seeing different things.The Optimists (Bullish): Some experts believe the job market is stronger than ever. Jefferies is currently leading with the highest expectations for job growth, which is detailed in Who’s got the most bullish NFP forecast this time around?. Similarly, JP Morgan believes hiring is actually speeding up, arguing that the momentum is still there even as the economy settles down, as explained in Non-farm payrolls seen accelerating as unemployment rate holds steady – JP Morgan.The Cautious Observers: On the other hand, Citi expects decent job creation but warns that the unemployment rate might slowly rise. They see this as a sign of the labor market “balancing out” rather than crashing. You can read more about their view in US payrolls to stay supported but unemployment rate seen increasing further – Citi.What Else Is Driving Stocks? (AI & Energy) Even with all this focus on economic data (“macro noise”), stock market investors are increasingly excited about long-term growth themes like Artificial Intelligence and energy.The Hot Story: A prime example is the nuclear energy company Oklo. Its stock surged because big tech companies need massive amounts of power for their AI data centers. This trend was highlighted when Oklo jumps 20% in pre-market as Meta unveils nuclear deals to power data centers, showing that stories about future technology often move stock prices more than standard economic reports.Today’s Nasdaq rally was not random and not purely technical. It was built on a failed downside auction, early buyer intervention, and a clean reclaim of key value levels.As long as selling pressure continues to be absorbed and price holds above reclaimed value, the directional bias remains bullish. That said, the easiest portion of the move has likely passed. New positioning near resistance requires patience, selectivity, and confirmation rather than urgency.This analysis is based on proprietary order flow and orderFow Intel and is intended as decision support, not financial advice. Trade at your own risk. This article was written by Itai Levitan at investinglive.com. 🔗 Source 💡 DMK Insight Nasdaq futures showed initial weakness, but here’s why that shift matters now: The early session dip below recent value might’ve spooked some traders, but

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether