📰 DMK AI Summary Ethereum’s co-founder, Vitalik Buterin, believes the blockchain trilemma has been resolved with the introduction of PeerDAS and zkEVMs. These advancements aim to enhance Ethereum’s scalability, security, and decentralization. Buterin highlighted that PeerDAS is already live on the mainnet, while zkEVMs are in the alpha stage and expected to be fully operational within four years. 💬 DMK Insight Vitalik Buterin’s announcement about solving the blockchain trilemma signifies a significant milestone for Ethereum. The successful implementation of PeerDAS and zkEVMs could pave the way for a more robust and efficient decentralized network. This development could boost confidence in Ethereum’s ability to address key challenges in the crypto space, potentially attracting more interest from investors and developers. 📊 Market Content These advancements in Ethereum’s infrastructure could have a positive impact on its performance and adoption in the broader cryptocurrency market. As Ethereum continues to improve its scalability and security features, it may become more competitive compared to other blockchain platforms. Traders and investors in the crypto market might see this as a promising sign for Ethereum’s long-term growth and sustainability.

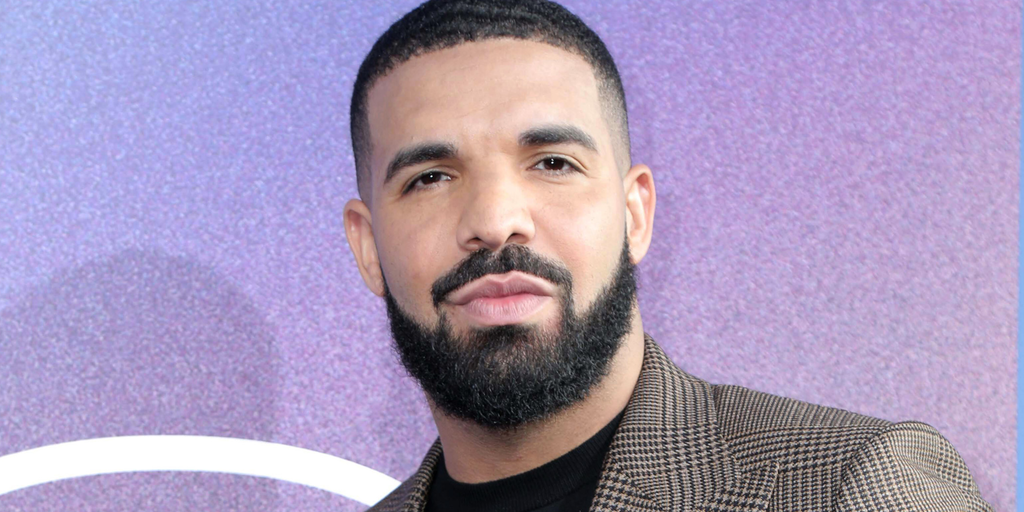

Rapper Drake Faces RICO Lawsuit for Promoting and Using Crypto Casino Stake

Famed rapper Drake is one of the named defendants in a new RICO class-action lawsuit involving his actions on crypto casino Stake. 🔗 Source 💡 DMK Insight Drake’s involvement in a RICO lawsuit could shake up the crypto casino space significantly. This isn’t just about celebrity antics; it raises questions about the legitimacy of crypto gambling platforms like Stake. If the lawsuit gains traction, it could lead to increased scrutiny from regulators, impacting the broader crypto market. Traders should be aware of potential volatility in related assets, particularly those tied to online gambling or crypto casinos. Watch for how this legal battle unfolds, as it could set precedents affecting investor sentiment and regulatory approaches. Keep an eye on Stake’s operational metrics and any shifts in user engagement, as these could signal market reactions. The real story is how this could ripple through the crypto ecosystem, especially if other celebrities face similar scrutiny or if regulatory bodies step in more aggressively. For now, monitor Stake’s performance and any legal updates closely, as they could provide actionable insights into market movements. 📮 Takeaway Watch for updates on the RICO lawsuit against Drake and Stake, as they could impact crypto casino stocks and related assets significantly.

Goldman Sachs Upgrades Coinbase, Downgrades eToro—Here's Why

Goldman Sachs issued a new price target for Coinbase on Monday, while upgrading the exchange to “Buy” from “Neutral.” COIN jumped 8%. 🔗 Source 💡 DMK Insight Goldman Sachs just upgraded Coinbase to ‘Buy’ and here’s why that matters: An 8% jump in COIN’s price signals renewed confidence in the crypto exchange, especially as institutional interest appears to be picking up. This upgrade comes at a pivotal moment when regulatory clarity is slowly emerging, which could attract more retail and institutional investors. Traders should watch for COIN to hold above recent resistance levels, ideally around the $80 mark, as a sustained move above this could trigger further bullish momentum. But don’t overlook the broader implications; if Coinbase continues to gain traction, it could positively influence other crypto assets, particularly those tied to DeFi or NFT markets. Watch for correlated movements in Bitcoin and Ethereum, as their price action often impacts sentiment across the board. Keep an eye on trading volumes as well; higher volumes could indicate stronger conviction behind this rally. 📮 Takeaway Watch COIN closely for a sustained hold above $80, as it could lead to further bullish momentum and impact related crypto assets.

Elon Musk's xAI Refuses to Rein In Grok as Non-Consensual Deepfakes Run Wild

Users are getting Grok to generate non-consensual images of women. Elon Musk’s AI platform says this is just another form of free speech. 🔗 Source 💡 DMK Insight The controversy surrounding Grok’s use of AI to generate non-consensual images highlights a critical intersection of technology, ethics, and market sentiment. As traders, we need to recognize that developments in AI can significantly impact public perception and regulatory scrutiny, which in turn affects tech stocks and related assets. If Grok’s practices lead to increased backlash or regulatory action, it could create volatility not just for Musk’s ventures but for the broader tech sector as well. Moreover, this situation could set a precedent for how AI technologies are regulated moving forward. If regulators clamp down on AI-generated content, companies involved in AI development could face increased operational costs or legal challenges. Traders should keep an eye on stocks of companies involved in AI and tech, particularly those with similar capabilities. The real story is how this could ripple through the market, affecting investor sentiment and potentially leading to sell-offs in tech stocks if public backlash escalates. Watch for any announcements from regulatory bodies regarding AI content generation, as these could serve as key indicators for market movements in the tech sector. 📮 Takeaway Monitor regulatory developments around AI content generation; any significant announcements could impact tech stocks and investor sentiment.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether