in various aspects. While Bybit stands out for derivatives trading and innovative products, Phemex is known for its beginner-friendly interface. In this article, we’ll compare the two cryptocurrency exchanges across The post Bybit Vs Phemex: Which Crypto Exchange Is Better? appeared first on NFT Evening. 🔗 Source 💡 DMK Insight So, the ongoing debate between Bybit and Phemex is more than just a preference—it’s about strategy. Bybit’s strength in derivatives trading offers advanced traders the tools they need for high-risk, high-reward strategies, especially in volatile markets. If you’re looking to leverage positions, Bybit’s innovative products could be your go-to. However, Phemex’s user-friendly interface makes it a solid choice for beginners or those who prefer a simpler trading experience. Here’s the kicker: as the crypto market evolves, the choice of exchange can significantly impact your trading outcomes. Bybit might attract more experienced traders, potentially leading to increased liquidity and tighter spreads, while Phemex could see a surge in retail participation. Keep an eye on trading volumes and market sentiment around these platforms, as shifts could signal broader trends in crypto adoption. Watch for any announcements from either exchange that might affect trading fees or new product launches, as these could be game-changers for your trading strategy. 📮 Takeaway Monitor trading volumes on Bybit and Phemex closely; shifts could indicate broader market trends and affect your trading strategy.

Samourai Wallet co-founder spends Christmas Eve recounting first day in prison

A prison letter from Keonne Rodriguez has reignited debate over crypto privacy tools, developer liability and executive clemency. 🔗 Source 💡 DMK Insight Keonne Rodriguez’s prison letter is stirring the pot on crypto privacy—here’s why that’s crucial for traders right now. The ongoing debate about crypto privacy tools and developer liability is more than just a legal issue; it directly impacts market sentiment and regulatory scrutiny. As governments ramp up their focus on crypto regulations, traders need to be aware of how these discussions could influence the adoption of privacy coins and related assets. If privacy tools face increased restrictions, it could lead to a sell-off in those markets, while assets that comply with regulatory standards might see a surge. Look at the broader context: as regulatory frameworks evolve, assets like Monero or Zcash could face headwinds, while more compliant projects might gain traction. Traders should keep an eye on key price levels for these assets, especially during any regulatory announcements. The real story here is how this debate could shape the future landscape of crypto trading—so stay alert for any shifts in sentiment or policy that could create volatility in the coming weeks. 📮 Takeaway Watch for regulatory developments around crypto privacy tools, as they could impact prices of privacy coins significantly in the near term.

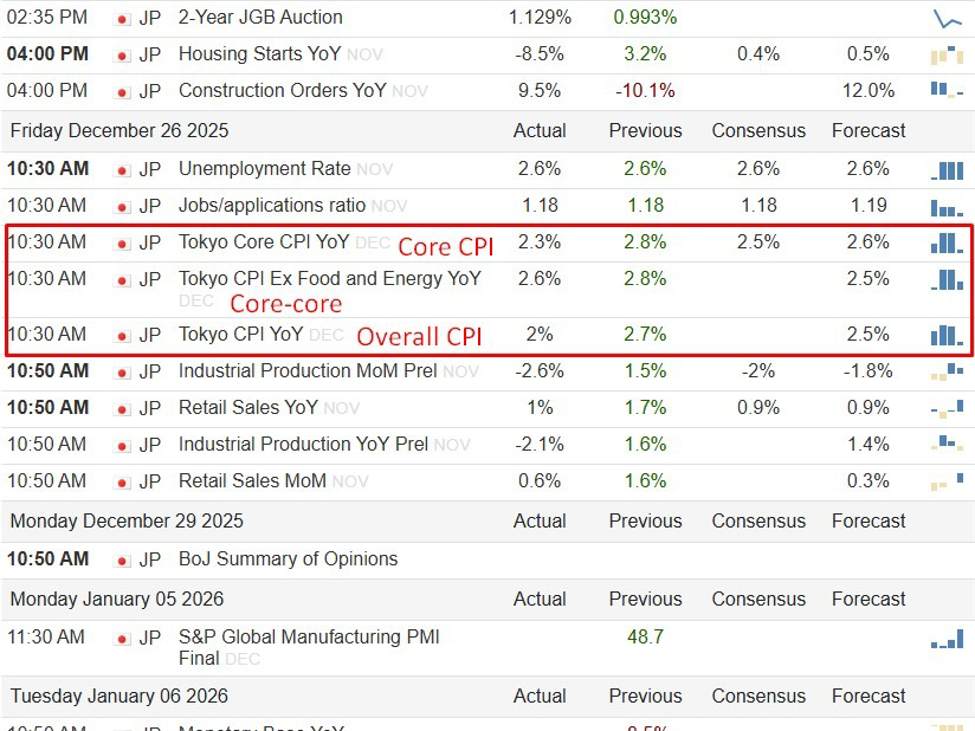

Tokyo CPI eased in December but stayed above target, BOJ to stay on gradual rate hike path

The TL;DR summary:Tokyo core CPI slowed to 2.3% y/y in Dec (vs. prev 2.8%, exp 2.5%), driven by lower energy and utility costs.Core-core CPI eased to 2.6% y/y (prev 2.8%), but remains above the BOJ’s 2% target, signalling persistent demand-side pressure.Headline CPI cooled to 2.0% y/y (prev 2.7%), marking the first clear deceleration since August.Data softens urgency, not direction, of BOJ policy; inflation remains consistent with gradual further tightening after last week’s hike to 0.75%.Market read-through: modest yen softness near term, JGB front-end consolidation, Nikkei supported by reduced immediate tightening risk.The screenshot above is via TradingEconomics. —Tokyo inflation cooled more than expected in December, but remained comfortably above the Bank of Japan’s 2% target, keeping the policy normalisation story intact even as near-term urgency eased.Core consumer prices in the capital, excluding fresh food, rose 2.3% y/y, slowing from 2.8% in November and undershooting market expectations of 2.5%. The deceleration was driven largely by lower utility and energy costs, alongside a moderation in food price gains.A closely watched “core-core” measure that strips out both fresh food and energy also softened, easing to 2.6% y/y from 2.8% previously, while headline CPI slowed to 2.0% from 2.7%. Together, the figures marked the first clear easing in Tokyo inflation momentum since August.Despite the slowdown, all three gauges remain at or above the BOJ’s inflation target, reinforcing the view that underlying price pressures have become entrenched. Tokyo CPI is widely regarded as a leading indicator for nationwide trends, suggesting inflation is cooling gradually rather than collapsing.The data follows last week’s Bank of Japan decision to raise its policy rate to 0.75%, the highest level in roughly three decades. Governor Kazuo Ueda has stressed that further tightening will follow if wages and prices evolve in line with the central bank’s outlook, while deliberately avoiding guidance on pace or terminal levels.Markets now see the December data as consistent with the BOJ’s baseline scenario: inflation easing as energy effects fade, but remaining sufficiently firm to justify additional rate hikes over time. Analysts continue to expect a gradual hiking cycle, with rates rising roughly every six months and a terminal level near 1.25%, assuming wage growth remains solid. BOJ policy implicationsThe softer-than-expected core print slightly reduces pressure for an imminent follow-up hike but does little to derail the broader tightening trajectory. With core inflation still above target and wage dynamics supportive, the BOJ is likely to proceed cautiously. A pause seems likely at the next meeting, on January 22–23, 2026. Market impact: yen, JGBs, Nikkei:Yen: The downside CPI surprise may cap near-term yen gains, especially if US yields remain elevated, but persistent above-target inflation limits scope for sustained depreciation.JGBs: Front-end yields may consolidate after the recent sell-off, though the medium-term bias remains toward higher yields as policy normalisation continues.Nikkei: Equities may welcome reduced near-term tightening pressure, particularly rate-sensitive sectors, while exporters remain sensitive to yen swings. This article was written by Eamonn Sheridan at investinglive.com. 🔗 Source 💡 DMK Insight Tokyo’s core CPI slowing to 2.3% is a mixed bag for traders: On one hand, the drop from 2.8% suggests easing inflationary pressures, which could influence the Bank of Japan’s (BOJ) monetary policy. If the BOJ perceives that inflation is stabilizing, they might delay any interest rate hikes, keeping the yen weaker in the short term. This could be a signal for forex traders to consider short positions on JPY against stronger currencies like USD or EUR. On the flip side, core-core CPI remains above the BOJ’s 2% target, indicating that demand-side pressures are still in play. This could lead to volatility in Japanese equities as investors weigh the potential for future rate adjustments. Traders should keep an eye on the upcoming BOJ meetings and any comments from officials regarding inflation targets. Key levels to watch include the USD/JPY pair; if it breaks above recent highs, it could indicate a stronger dollar amid a dovish BOJ stance. Conversely, if inflation continues to surprise on the upside, we might see a shift in sentiment that could strengthen the yen. 📮 Takeaway Watch the USD/JPY pair closely; a break above recent highs could signal a stronger dollar as the BOJ maintains a dovish stance.

Ethereum in 2026: Glamsterdam and Hegota forks, L1 scaling and more

The coming year will see perfect parallel processing, big increases in the gas limit and number of data blobs, and 10% of Ethereum’s network switching to ZK. 🔗 Source 💡 DMK Insight Ethereum’s upcoming upgrades could reshape trading strategies significantly. With ETH currently at $2,903.29, the anticipated enhancements—like increased gas limits and the shift to zero-knowledge (ZK) technology—could lead to improved transaction speeds and lower fees. This is crucial for traders, especially those focused on high-frequency or arbitrage strategies, as faster transactions can mean the difference between profit and loss. If 10% of the network transitions to ZK, we might see a surge in demand for ETH as users flock to the more efficient platform, potentially pushing prices higher. But here’s the flip side: if the upgrades don’t roll out smoothly, we could see a backlash, leading to volatility. Traders should keep an eye on key resistance levels around $3,000 and support near $2,800. Monitoring the Ethereum network’s performance post-upgrade will be essential, especially in the first quarter of the year, as any hiccups could create short-term trading opportunities or risks. 📮 Takeaway Watch for ETH to break above $3,000 or hold above $2,800; the upcoming upgrades could trigger significant price movements.

Japan Tokyo CPI ex Fresh Food (YoY) came in at 2.3% below forecasts (2.5%) in December

Japan Tokyo CPI ex Fresh Food (YoY) came in at 2.3% below forecasts (2.5%) in December 🔗 Source 💡 DMK Insight Japan’s CPI miss at 2.3% could signal a shift in monetary policy expectations. For traders, this lower-than-expected inflation reading might prompt the Bank of Japan to reconsider its current stance on interest rates. If inflation continues to lag behind forecasts, we could see a more dovish approach from the BOJ, which would impact the yen and Japanese equities. Traders should watch the USD/JPY pair closely; a sustained move above key resistance levels could indicate a shift in sentiment towards the dollar as a safe haven. Additionally, this CPI data could ripple through global markets, affecting commodities and risk assets as investors reassess their positions. But here’s the flip side: if inflation rebounds in the coming months, the BOJ might stick to its current policies, leading to volatility in the yen. Keep an eye on the next inflation report and any BOJ commentary for clues on future direction. The immediate takeaway is to monitor the USD/JPY for potential breakout levels, especially if it approaches 140, which could trigger further dollar strength. 📮 Takeaway Watch the USD/JPY closely; a breakout above 140 could signal a shift in dollar strength amid BOJ policy changes.

Japan Jobs / Applicants Ratio meets expectations (1.18) in November

Japan Jobs / Applicants Ratio meets expectations (1.18) in November 🔗 Source 💡 DMK Insight Japan’s jobs-to-applicants ratio hitting 1.18 is a key indicator for traders: This figure, meeting expectations, suggests a stable labor market, which can influence the Bank of Japan’s monetary policy decisions. A strong job market typically leads to increased consumer spending, potentially boosting the Japanese economy. For forex traders, this could mean a stronger yen against currencies like the USD, especially if the BOJ signals a shift towards tightening. Keep an eye on the USD/JPY pair; if it breaks below recent support levels, it could indicate a bearish trend for the dollar. On the flip side, if the ratio had significantly exceeded expectations, it might have raised concerns about inflationary pressures, prompting a more aggressive stance from the BOJ. As it stands, the current data suggests a wait-and-see approach. Watch for upcoming economic indicators, particularly wage growth and inflation data, which could further impact the yen’s strength in the coming weeks. 📮 Takeaway Monitor the USD/JPY pair closely; a break below support could signal a bearish trend for the dollar as Japan’s job market remains stable.

Japan Tokyo Consumer Price Index (YoY) dipped from previous 2.7% to 2% in December

Japan Tokyo Consumer Price Index (YoY) dipped from previous 2.7% to 2% in December 🔗 Source 💡 DMK Insight Japan’s CPI drop to 2% is a big deal for traders: it signals potential shifts in monetary policy. A lower inflation rate could lead the Bank of Japan to reconsider its ultra-loose monetary stance, which has been a cornerstone of its economic strategy. If the trend continues, we might see a stronger yen as interest rates could rise, impacting forex traders significantly. Watch for how this CPI data influences USD/JPY and other pairs. The market’s reaction could also ripple into equities, especially those tied to consumer spending. Keep an eye on the 2% level—if inflation stabilizes around here, it could set the stage for a more hawkish BOJ stance. But here’s the flip side: if inflation remains subdued, it could signal underlying economic weakness, which might keep the BOJ on the sidelines longer than expected. Traders should monitor upcoming economic indicators closely, especially any shifts in consumer sentiment or spending that could provide further context to this CPI reading. 📮 Takeaway Watch the 2% CPI level closely; a sustained dip could prompt the BOJ to shift its monetary policy, impacting the yen and related forex pairs.

Japan Tokyo CPI ex Food, Energy (YoY) dipped from previous 2.8% to 2.3% in December

Japan Tokyo CPI ex Food, Energy (YoY) dipped from previous 2.8% to 2.3% in December 🔗 Source 💡 DMK Insight Japan’s CPI drop to 2.3% from 2.8% is a big deal for traders: This decline signals a potential easing of inflationary pressures, which could influence the Bank of Japan’s monetary policy. If inflation continues to cool, we might see a shift in interest rates, impacting the yen and related forex pairs. Traders should keep an eye on the USD/JPY, especially if it approaches key support levels around 130.00. A sustained move below this level could indicate further weakness in the yen, prompting a reevaluation of long positions. But here’s the flip side: if inflation rebounds unexpectedly, it could lead to a hawkish shift from the BOJ, catching traders off guard. Watch for upcoming economic indicators and central bank statements that could provide clarity. The next few weeks will be crucial for gauging market sentiment and positioning ahead of potential volatility. 📮 Takeaway Monitor the USD/JPY closely; a drop below 130.00 could signal further yen weakness, while inflation surprises could shift BOJ policy unexpectedly.

Japan Unemployment Rate meets forecasts (2.6%) in November

Japan Unemployment Rate meets forecasts (2.6%) in November 🔗 Source 💡 DMK Insight Japan’s unemployment rate holding steady at 2.6% is a mixed bag for traders: On one hand, this stability suggests a resilient labor market, which could support consumer spending and economic growth. For forex traders, the yen might see some bullish sentiment if this data leads to speculation about potential monetary policy adjustments from the Bank of Japan. However, with inflation still a concern, the central bank’s next moves will be crucial. But here’s the flip side: if the unemployment rate remains unchanged while inflation pressures persist, it could signal underlying economic weaknesses that might not be immediately visible. Traders should keep an eye on related economic indicators, like wage growth and consumer confidence, which could provide a fuller picture. Watch for any shifts in the USD/JPY pair, especially around key technical levels, as these data points could influence market sentiment significantly in the coming weeks. 📮 Takeaway Monitor the USD/JPY pair closely; any shifts in monetary policy speculation could lead to volatility around the 2.6% unemployment rate.

Japan Industrial Production (MoM) below forecasts (-2%) in November: Actual (-2.6%)

Japan Industrial Production (MoM) below forecasts (-2%) in November: Actual (-2.6%) 🔗 Source 💡 DMK Insight Japan’s industrial production dropping 2.6% is a red flag for traders: This miss against forecasts signals potential weakness in the economy, which could ripple through global markets. A decline in industrial output often hints at reduced demand, affecting everything from commodities to currency pairs linked to Japan. For forex traders, this could mean a bearish outlook for the yen, especially if the trend continues. Watch for how this impacts the USD/JPY pair, particularly if it breaks below key support levels. On the flip side, some might argue that this could lead to more stimulus measures from the Bank of Japan, potentially creating a short-term buying opportunity. However, the immediate sentiment is likely to lean bearish as traders digest this data. Keep an eye on upcoming economic indicators, as further declines could solidify a bearish trend in Japanese assets. 📮 Takeaway Monitor the USD/JPY pair closely; a break below recent support levels could signal further yen weakness amid declining industrial production.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether