Fundstrat Global Advisors’ Head of Research Tom Lee, who is chairman of BitMine Immersion Technologies, shares his perspective on Ethereum. He explains how the asset is being leveraged by crypto treasury firms, as well as a growing number of financial institutions. 🔗 Source 💡 DMK Insight Ethereum’s current price at $3,009.17 is drawing institutional interest, and here’s why that matters: As Tom Lee points out, crypto treasury firms are increasingly adopting Ethereum, which signals a shift in how institutions view digital assets. This trend could lead to increased demand, pushing prices higher in the short term. With ETH breaking above key resistance levels recently, traders should keep an eye on the $3,100 mark as a potential breakout point. If it holds, we could see a bullish run towards $3,300. But don’t ignore the flip side; if ETH fails to maintain momentum, a pullback could test support around $2,800. Watch for any news from financial institutions regarding their crypto strategies, as this could create volatility. Additionally, monitor on-chain metrics like active addresses and transaction volumes, which can provide insights into market sentiment and potential price movements. 📮 Takeaway Keep an eye on Ethereum’s $3,100 resistance; a breakout could signal a bullish trend, while a failure may test $2,800 support.

Morning Minute: Aave Takes Aim at Banks, Fintechs with New Aave App

Aave’s latest Neobank app will have TradFi sweating, with more yield and more insurance protection than ever offered before. 🔗 Source 💡 DMK Insight Aave’s Neobank app could disrupt traditional finance by offering higher yields and enhanced insurance, pushing traders to rethink their strategies. With the rise of decentralized finance (DeFi), Aave is positioning itself to attract users who are tired of low returns from traditional banks. If they can deliver on these promises, we might see a significant shift in capital flows from traditional finance to DeFi platforms. Traders should keep an eye on how this affects liquidity in both crypto and traditional markets. If Aave’s app gains traction, it could lead to a broader adoption of DeFi, impacting assets like Ethereum and other DeFi tokens. Watch for any announcements regarding user adoption rates or partnerships, as these could serve as catalysts for price movements in the broader crypto market. 📮 Takeaway Monitor Aave’s user adoption and yield rates closely; significant growth could shift capital from TradFi to DeFi, impacting Ethereum and related assets.

New Wave of Solana ETFs Hits the Markets as Fidelity, Canary, and VanEck Roll Out

Several Solana ETFs are launching across U.S. exchanges this week as asset managers test demand for products tied to altcoins and staking. 🔗 Source 💡 DMK Insight Solana ETFs hitting U.S. exchanges could shake up altcoin trading dynamics. With SOL currently at $136.43, the launch of these ETFs signals a growing institutional interest in altcoins, particularly those with staking capabilities. This could lead to increased liquidity and volatility in the Solana market, making it a prime target for day traders and swing traders alike. If demand surges, we might see SOL push past key resistance levels, potentially opening the door for a breakout above recent highs. But here’s the flip side: if these ETFs fail to attract significant capital, it could lead to a sharp pullback, affecting not just SOL but also correlated assets like LTC, which is currently priced at $92.42. Traders should keep an eye on volume trends and any news related to ETF performance, as these will be critical indicators of market sentiment in the coming weeks. 📮 Takeaway Watch SOL closely; if it breaks above $140, it could signal a strong bullish trend, but a drop below $130 may indicate weakness.

European Bank Revolut Taps Ethereum Network Polygon for Remittances, Stablecoin Payments

Revolut is teaming with Ethereum scaling network Polygon to power crypto remittances and stablecoin payments. 🔗 Source 💡 DMK Insight Revolut’s partnership with Polygon could reshape crypto remittances, and here’s why that matters: With ETH currently at $3,009.17, this collaboration taps into the growing demand for efficient and cost-effective cross-border transactions. By leveraging Polygon’s scaling solutions, Revolut aims to reduce transaction fees and improve speed, making crypto more accessible for everyday users. This move aligns with broader trends in the crypto space where remittances are increasingly being viewed as a viable use case for blockchain technology. Traders should keep an eye on how this affects ETH’s price action, particularly if we see increased transaction volumes on the network. However, there’s a flip side to consider. While this partnership could drive ETH demand, it also raises questions about the sustainability of transaction fees and whether this will lead to a significant influx of new users or just a shift in existing user behavior. Watch for any spikes in Ethereum’s network activity and how that correlates with price movements. Key levels to monitor include support around $2,900 and resistance at $3,200. If ETH can maintain above $3,000, it may signal bullish momentum fueled by this news. 📮 Takeaway Watch for ETH to hold above $3,000 as Revolut’s partnership with Polygon could drive increased transaction volumes and price momentum.

Bitcoin Miner Canaan’s Stock Spikes After Q3 Revenue Rise, Even as BTC Falls

Canaan’s stock jumped Tuesday after the Bitcoin mining firm reported a revenue spike, though Bitcoin fell to a seven-month low overnight. 🔗 Source 💡 DMK Insight Canaan’s stock surge amidst Bitcoin’s decline highlights a disconnect in market sentiment. While Canaan reported a revenue spike, Bitcoin’s drop to a seven-month low signals underlying weakness in the crypto market. This divergence could indicate that investors are betting on the resilience of mining firms despite bearish trends in Bitcoin prices. Traders should watch for how this affects Canaan’s stock in the coming days, especially if Bitcoin continues to struggle. If Bitcoin breaks below key support levels, it could drag down related stocks, including Canaan, despite their recent performance. Keep an eye on Canaan’s price action around its recent highs and lows, as any significant pullback could present a buying opportunity for those looking to capitalize on mining stocks in a bearish crypto environment. 📮 Takeaway Watch Canaan’s stock closely; if Bitcoin dips further, it may impact mining stocks despite their current strength.

Mt. Gox Moves Nearly $1 Billion in Bitcoin—Are More Repayments Imminent?

Wallets belonging to defunct Bitcoin exchange Mt. Gox moved nearly $1 billion worth of the top crypto asset on Tuesday. 🔗 Source 💡 DMK Insight Mt. Gox wallets just moved nearly $1 billion in Bitcoin, and here’s why that matters: This massive transfer could signal a potential sell-off or market shake-up, especially if these coins hit the market. Traders should be wary of increased volatility, as historical patterns show that large movements from dormant wallets often precede price corrections. Given Bitcoin’s current price dynamics, this could lead to a test of key support levels. If the market reacts negatively, we might see Bitcoin testing support around recent lows. On the flip side, if the market absorbs this influx without significant price drops, it could indicate strong underlying demand. Keep an eye on trading volumes and sentiment in the coming days. A spike in selling pressure could trigger stop-loss orders, leading to cascading effects across the crypto market. Watch for Bitcoin’s response over the next week, particularly around any psychological levels like $30,000. Institutions and retail traders alike will be closely monitoring this situation, so positioning now could be crucial. 📮 Takeaway Watch Bitcoin closely over the next week; a test of support around $30,000 could be imminent if selling pressure increases from the Mt. Gox movement.

Prediction Market Myriad Partners With Walrus Decentralized Data Storage Layer

The partnership will see Myriad media stored on the developer platform, creating an immutable record with applications in DeFi and AI. 🔗 Source 💡 DMK Insight Myriad’s partnership to store media on a developer platform could reshape DeFi and AI applications. This move is significant because it introduces a new layer of data integrity and accessibility, crucial for both sectors. Immutable records can enhance trust and transparency, which are vital in attracting institutional investment. Traders should keep an eye on how this partnership influences related tokens or platforms that might integrate Myriad’s technology. If the market responds positively, we could see a bullish trend in DeFi assets, especially those focused on data security and AI functionalities. However, there’s a flip side: the hype around new partnerships often leads to volatility. If expectations aren’t met, we might see a sharp correction. Watch for market reactions over the next few weeks as more details emerge about the integration and its practical applications. Key metrics to monitor include trading volumes and price movements of associated assets, particularly in the DeFi space. 📮 Takeaway Keep an eye on Myriad’s integration impact on DeFi and AI sectors; watch for trading volume spikes in related assets over the next few weeks.

BTC Dipped to $90K! BTC wipes out 2025 Gains! Monad CoFounder Interview!

Crypto majors are very red as btc briefly fell below $90k; btc -4% at $91,300; eth -5% at $3,050, bnb -2% at $915, sol -3% at $137. Icp (+9%), aster (+7%) and hype (+5%) led top movers. Crypto fear & greed remained in extreme fear at 11, now in that range for 6 straight days. Bitcoin wiped out its 2025 gains after falling below $92k (briefly sub-$90k), now down 2% on the ytd. The cboe unveiled “continuous” bitcoin and ethereum futures with 10-year terms as a perps-like alternative. The white house is considering to allow the irs to track and tax crypto holdings on foreign exchanges. Vitalik buterin and the ethereum foundation launched kohaku as a new initiative to bake privacy and security into ethereum wallets instead of treating them as add-ons. Trump international maldives announced tokenized real-estate stakes, letting investors buy blockchain-based shares in its 80-villa luxury resort. Hive stock jumped after posting record q2 revenue and landing new ai-infra deals, as investors rotated into miners despite broader crypto weakness. Japan is changing its crypto tax rules, dropping cap gains from 55% to 20%. Coinbase ventures announced an investment in usd ai. 🔗 Source 💡 DMK Insight Bitcoin’s dip below $90k is a wake-up call for traders: extreme fear is gripping the market. With BTC currently at $91,300, down 4%, and ETH trailing at $3,050, the sentiment shift is palpable. The extreme fear index at 11 signals a potential capitulation phase, which often precedes a rebound, but it also raises the risk of further declines. Traders should watch for support levels around $90k for BTC and $3,000 for ETH—breaking these could trigger more selling pressure. On the flip side, altcoins like ICP and Aster are defying the trend, suggesting some capital is rotating into less correlated assets. This divergence could indicate a market seeking value, but it also highlights the volatility and uncertainty in the broader crypto space. Keep an eye on the daily charts for any reversal patterns, and be cautious of potential cascading effects if major support levels fail. 📮 Takeaway Watch BTC closely around the $90k level; a break could lead to further declines, while altcoins like ICP may offer short-term opportunities.

Google Releases Its Most Powerful AI Model, Gemini 3—Here's What You Need to Know

Google’s Gemini 3 Pro outperforms previous models across reasoning and multimodal benchmarks. It’s available on AI Studio, but not the consumer Gemini app. 🔗 Source 💡 DMK Insight Google’s Gemini 3 Pro is making waves in the AI space, and here’s why that matters: the advancements in reasoning and multimodal capabilities could shift market dynamics significantly. As AI continues to integrate into various sectors, this model’s performance might influence tech stocks and related markets, especially those heavily invested in AI development. Traders should keep an eye on how this impacts companies like NVIDIA and Microsoft, which are already leveraging AI in their products. But there’s a flip side—while the hype around AI is strong, it’s crucial to assess whether these advancements translate into tangible financial performance. If Gemini 3 Pro doesn’t lead to increased adoption or revenue growth, we could see a correction in overvalued tech stocks. Watch for earnings reports and market reactions in the coming weeks, particularly around key price levels in tech indices. The immediate focus should be on how this news affects sentiment and trading volumes in AI-related stocks, especially as we approach the end of the quarter. 📮 Takeaway Monitor tech stocks like NVIDIA and Microsoft for potential volatility as AI advancements from Google’s Gemini 3 Pro unfold, especially around upcoming earnings reports.

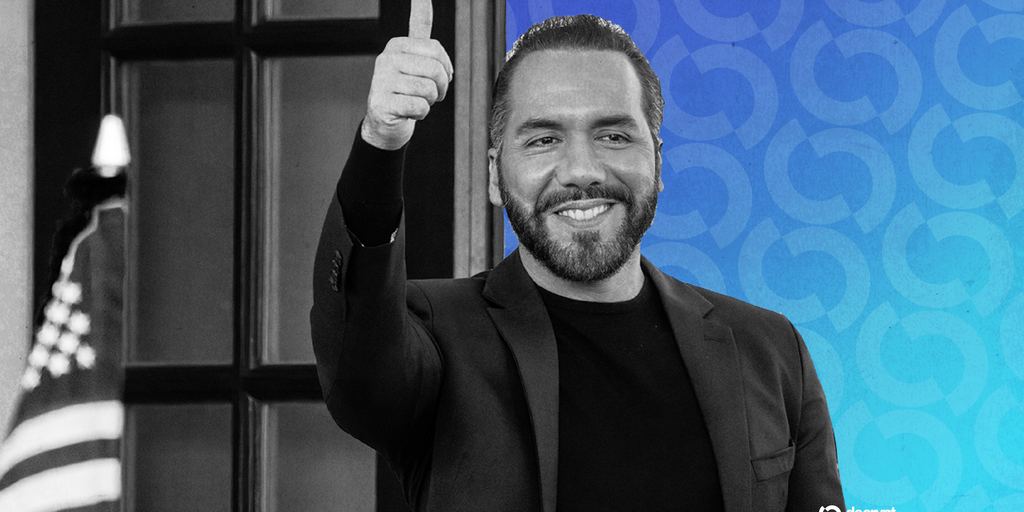

Did El Salvador Really Just Buy $100 Million in Bitcoin?

The IMF has insisted that past increases were internal transfers. 🔗 Source 💡 DMK Insight The IMF’s assertion that past increases were merely internal transfers is a critical signal for traders navigating global markets. This perspective could influence currency valuations and investor sentiment, particularly in emerging markets where IMF policies often dictate economic stability. If traders interpret this as a sign of underlying weakness in global economic structures, we might see increased volatility in forex pairs tied to these economies, especially those reliant on IMF support. Moreover, this could ripple through commodities and equities, as investor confidence wanes. For instance, currencies like the Turkish Lira or Argentine Peso, which have historically reacted to IMF interventions, could see heightened trading activity. Traders should keep an eye on related economic indicators, such as inflation rates and GDP growth, which could be impacted by these IMF policies. Looking ahead, watch for any official statements or policy changes from the IMF that could clarify their stance. These could serve as pivotal moments for market reactions, especially in the forex space where sentiment can shift rapidly based on perceived economic health. 📮 Takeaway Monitor IMF announcements closely; shifts in their policy could trigger significant volatility in emerging market currencies and related assets.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether