Changpeng Zhao (CZ) and Peter Schiff will debate the case for Bitcoin vs. tokenized gold. Binance founder CZ is a committed Bitcoin maximalist. After years … 🔗 Source 💡 DMK Insight The upcoming debate between CZ and Schiff could ignite volatility in both Bitcoin and gold markets. With CZ’s strong Bitcoin stance, traders should watch for potential bullish sentiment in BTC, especially if he effectively counters Schiff’s arguments for tokenized gold. This debate isn’t just a clash of ideas; it could influence market perceptions and lead to price movements. If Bitcoin shows resilience and breaks above key resistance levels, say around $30,000, it could attract more buyers. Conversely, if Schiff’s points resonate, we might see a shift towards gold-backed assets, impacting gold ETFs and related securities. Keep an eye on trading volumes and sentiment shifts post-debate, as they could signal where the market is headed next. 📮 Takeaway Watch for Bitcoin’s reaction around $30,000 post-debate; a breakout could signal bullish momentum while a shift towards gold may indicate risk-off sentiment.

Aave Labs Secures Ireland Crypto License While Redefining Its DeFi Identity

Aave Labs has received a crypto license in Ireland. The authorization will let the company offer stablecoin on- and off-ramp services. The company behind the … 🔗 Source 💡 DMK Insight Aave Labs getting a crypto license in Ireland is a game changer for stablecoin liquidity. This move opens the door for Aave to facilitate smoother on- and off-ramp services, which could significantly increase trading volumes and attract institutional interest. With regulatory clarity in a major European market, Aave could see a surge in user adoption, especially among those looking for compliant ways to interact with stablecoins. Traders should keep an eye on how this impacts Aave’s token price and overall market sentiment, particularly in the context of broader crypto regulations in Europe. If Aave can capitalize on this momentum, it might push the price of its native token higher, especially if it breaks above key resistance levels. On the flip side, the market’s reaction could be muted if traders perceive this as a non-event or if other regulatory hurdles emerge. Watch for any price movements in Aave’s token and related stablecoins, as well as trading volumes in the coming weeks to gauge market sentiment. 📮 Takeaway Monitor Aave’s token price closely for potential breakouts, especially if trading volumes increase following the license news.

XRP ETF Tops All 2025 Launches With Record $58M Day-One Volume

Canary’s spot XRP ETF posted $26 million in volume during its first 30 minutes. XRPC closed its first trading day with $58 million—beating every 2025 … 🔗 Source 💡 DMK Insight XRP’s ETF debut is a game-changer, and here’s why: the $26 million volume in just 30 minutes signals strong institutional interest. This kind of volume not only reflects confidence in XRP but also suggests that traders should keep an eye on the $2.50 resistance level. If XRP can break through this, we might see a significant rally. The broader crypto market is still reeling from regulatory uncertainties, but this ETF launch could shift sentiment positively. However, it’s worth noting that while the initial excitement is palpable, profit-taking could lead to volatility. Watch for potential pullbacks around the $2.10 support level. Institutions are likely to be the key players here, so monitoring their movements could provide insights into future price action. 📮 Takeaway Watch for XRP to break the $2.50 resistance; a failure to hold above $2.10 could signal a pullback.

Bitcoin Dumps Below $97K—Dragonfly Calls It the ‘Easiest Bear Market’

Bitcoin fell below $97,000 on Friday morning. The cryptocurrency has now properly broken through the $100,000 floor. Dragonfly Capital partner Haseeb Qureshi reminded investors that … 🔗 Source 💡 DMK Insight Bitcoin’s drop below $97,000 is a significant psychological blow, breaking the $100,000 support level. This breach could trigger further selling pressure, especially among retail traders who may panic at the sight of such a critical level being violated. Historically, breaking key support levels often leads to cascading sell-offs, as stop-loss orders get triggered and fear spreads. Traders should monitor the $95,000 level closely; if it holds, we might see a consolidation phase, but if it breaks, the next target could be much lower. On the flip side, this could also present a buying opportunity for those with a longer-term outlook, especially if Bitcoin’s fundamentals remain strong. Keep an eye on volume metrics—if selling pressure decreases and buying interest picks up, it could signal a potential reversal. Watch for any news or developments that could influence market sentiment, as external factors often play a crucial role in price movements. 📮 Takeaway Watch the $95,000 level closely; a break below could lead to further declines, while a hold might indicate a potential buying opportunity.

Bitcoin Falls Below $98,000 — Will It Continue To Drop? We Asked ChatGPT

Bitcoin’s drop to $96,712 has intensified fears of a deeper holiday-season correction. We asked ChatGPT and Grok to explore the possibilities. CCN analyst Valdrin Tahiri … 🔗 Source 💡 DMK Insight Bitcoin’s drop to $96,712 is raising serious alarms for traders heading into the holiday season. A decline at this level could signal a broader market correction, especially as we approach a historically volatile period. Traders should be wary of potential cascading effects, particularly if Bitcoin breaks below key support levels. If we see sustained trading below $95,000, it could trigger stop-loss orders and exacerbate selling pressure. This drop also impacts altcoins, which often follow Bitcoin’s lead; expect increased volatility across the crypto market. On the flip side, if Bitcoin manages to hold above this level and bounce back, it could present a buying opportunity for those looking to capitalize on short-term rebounds. Keep an eye on trading volume and market sentiment indicators—these will be crucial in gauging whether this dip is a temporary blip or the start of a more significant downturn. 📮 Takeaway Watch for Bitcoin to hold above $95,000; a break below could lead to increased selling pressure across the market.

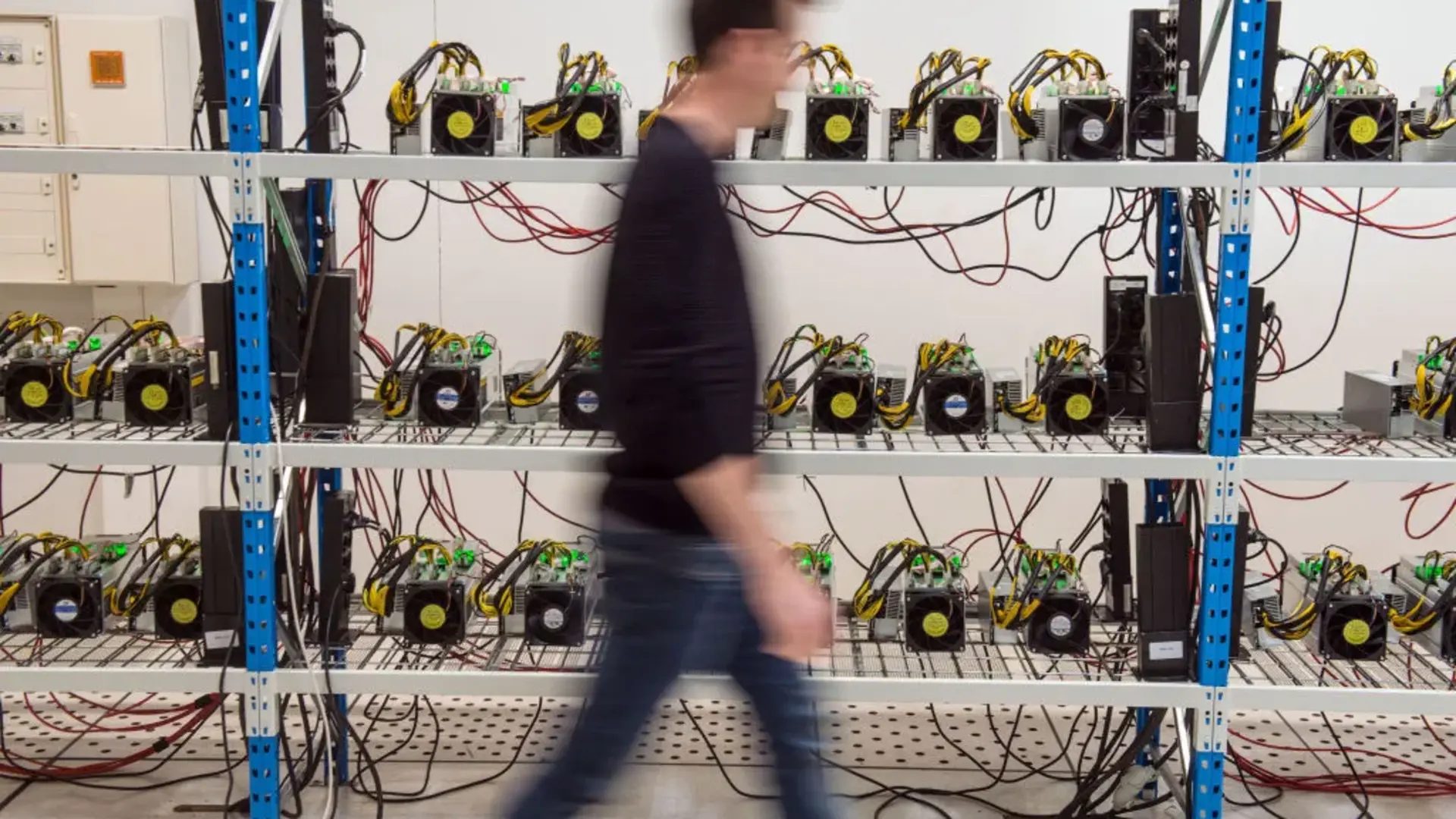

Bitfarms Dumps Bitcoin To Go All-In on AI as Crypto Mining Profitability Drops

Bitfarms will wind down Bitcoin mining over the next two years. The announcement makes Bitfarms the newest member of a fast-growing group of miners pivoting … 🔗 Source 💡 DMK Insight Bitfarms winding down Bitcoin mining is a big deal for the sector right now. This move signals a broader trend among miners who are reevaluating their operations in the face of rising energy costs and fluctuating Bitcoin prices. As more miners step back, we could see a tightening of supply, which might eventually lead to upward pressure on prices if demand holds steady. Traders should keep an eye on how this affects hash rates and overall network security. If Bitfarms’ exit leads to a significant drop in hash rate, it could create a buying opportunity for those looking to accumulate Bitcoin at lower prices. But there’s a flip side: if more miners follow suit, it could signal a lack of confidence in the market, which might spook retail investors. Watch for Bitcoin’s price action around key support levels. If it holds above recent lows, it could indicate resilience despite miner exits. Conversely, a break below those levels might trigger further selling pressure. Keep an eye on the next quarterly earnings reports from other mining companies to gauge industry sentiment and potential ripple effects on Bitcoin’s price. 📮 Takeaway Monitor Bitcoin’s support levels closely; a break below recent lows could signal further downside, while holding above may present a buying opportunity.

Bitcoin ETFs Log Second-Largest Outflows on Record While Altcoin ETFs Hold Firm, Post Inflows

Since Oct. 10, investors have withdrawn over $3.43 billion from Bitcoin ETFs. Thursday’s $870 million in outflows were the second-worst day ever for Bitcopin ETFs. … 🔗 Source 💡 DMK Insight Bitcoin ETF outflows hit a staggering $3.43 billion since October 10, and here’s why that matters: This massive withdrawal signals a growing skepticism among investors, likely driven by market volatility and regulatory uncertainties. The $870 million pulled on Thursday alone marks the second-worst day for Bitcoin ETFs, indicating a potential shift in sentiment. Traders should be wary; this could lead to further price declines as selling pressure mounts. If Bitcoin struggles to hold key support levels, we might see a cascade effect across the crypto market, impacting altcoins and related assets like Ethereum. Watch for Bitcoin to maintain support around recent lows—failure to do so could trigger more significant sell-offs. On the flip side, this could present a buying opportunity for contrarian traders if they believe the fundamentals of Bitcoin remain strong. Keep an eye on institutional buying patterns; if they start to accumulate during this dip, it could signal a reversal. Overall, monitor the ETF inflows closely as they can provide insight into broader market sentiment and potential recovery points. 📮 Takeaway Watch Bitcoin’s support levels closely; a break could lead to further declines, while institutional buying could signal a reversal.

Kraken CEO Says Bitcoin’s Price Decline Doesn’t Phase Firm, Claims Crypto Is ‘For Safety’

Kraken co-CEO Arjun Sethi argued that price drops come with the territory of crypto. Bitcoin’s recent sharp drop to $96,712 has intensified concerns of deeper … 🔗 Source

Alibaba Taps JPMorgan To Build Stablecoin-Like Payments System for Its $35B Commerce Network

Alibaba plans to launch a tokenized global payment network by December. The system uses a stablecoin-like model and is being developed with JPMorgan’s tokenization technology. … 🔗 Source 💡 DMK Insight Alibaba’s move to launch a tokenized payment network by December could shake up the global payments landscape. This initiative, leveraging JPMorgan’s tokenization tech, signals a significant shift towards digital currencies in mainstream commerce. For traders, this is crucial as it could enhance liquidity in crypto markets and drive adoption of stablecoins, particularly if Alibaba’s network gains traction. Watch for how this impacts related assets like USDT or USDC, which might see increased volume as businesses explore stablecoin options for transactions. Keep an eye on market sentiment leading up to the launch; if traders perceive this as a game-changer, we could see volatility in both crypto and traditional markets as institutions react to the news. On the flip side, there’s a risk of regulatory scrutiny, especially if the network faces pushback from governments wary of digital currencies. This could create short-term volatility, so monitor regulatory developments closely as the launch date approaches. 📮 Takeaway Watch for Alibaba’s tokenized payment network launch in December; it could drive stablecoin adoption and impact liquidity in crypto markets.

Gold-Backed Stablecoins Hit the Market—a Blow to Donald Trump’s GENIUS Plan?

Two new gold-backed stablecoins have launched recently. USDKG and GLDY present an alternative to Treasury-backed coins. Could the U.S. stablecoin push backfire if issuers shift … 🔗 Source 💡 DMK Insight Gold-backed stablecoins like USDKG and GLDY could shake up the stablecoin market significantly. With the recent volatility in Treasury-backed coins, these new entrants offer a hedge against inflation and economic uncertainty. Traders should watch how these stablecoins perform against traditional options, especially during market downturns. If they gain traction, we might see a shift in liquidity away from Treasury-backed assets, impacting their stability and attractiveness. This could also lead to increased demand for gold, influencing its price in the short to medium term. Keep an eye on trading volumes and adoption rates for USDKG and GLDY, as these metrics will signal whether they’re gaining traction or just a passing trend. The real story is how this could affect the broader crypto landscape. If issuers start favoring gold-backed options, we might see a ripple effect across other asset classes, particularly in commodities and alternative currencies. Watch for any regulatory responses as well, which could either bolster or hinder these new stablecoins. 📮 Takeaway Monitor the adoption rates of USDKG and GLDY closely; a significant shift could impact Treasury-backed coins and gold prices in the coming weeks.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether