Stablecoin giant Tether has tripled its USDT supply since 2023, and generating profits that would make major banks jealous. 🔗 Read Full Article 💡 DMK Insight Tether’s USDT supply surge to three times its 2023 level is a game-changer for crypto liquidity. This massive increase in supply could indicate heightened demand for stablecoins, especially as traders look for safe havens amid market volatility. With ETH currently at $3,598.21, the influx of USDT could lead to increased buying pressure on Ethereum and other altcoins. If traders start converting USDT into ETH, we might see a push towards key resistance levels, particularly around $3,700. But here’s the flip side: if Tether’s profits are coming from risky investments, it could raise concerns about the stability of USDT itself, potentially leading to a sell-off if confidence wanes. Keep an eye on trading volumes and sentiment indicators, as they will provide insight into whether this liquidity boost translates into sustained upward momentum or if it’s just a temporary spike. Watch for ETH to hold above $3,500 to maintain bullish sentiment in the short term. 📮 Takeaway Monitor ETH’s price action closely; a sustained hold above $3,500 could signal bullish momentum fueled by Tether’s increased USDT supply.

Nasdaq Reprimands TON Treasury for $558 Million Stock Sale, Crypto Buy

Nasdaq said TON Strategy failed to get shareholder approval for a massive crypto-fueled fundraise—but stopped short of delisting the company’s stock. 🔗 Read Full Article 💡 DMK Insight Nasdaq’s decision not to delist TON Strategy despite failed shareholder approval is a significant signal for crypto investors. This move suggests that Nasdaq is still willing to give the company a chance, which could stabilize investor sentiment in the short term. For traders, this could mean a potential buying opportunity if the stock shows resilience in the coming days. Keep an eye on trading volumes and price action around key support levels; a bounce could indicate renewed interest. However, the broader market context remains shaky, with regulatory scrutiny still looming over crypto assets. If TON Strategy can pivot and regain shareholder confidence, it might attract institutional interest, which could ripple through related crypto stocks. On the flip side, if the stock fails to recover, it could signal deeper issues within the company or the sector, leading to further sell-offs. Watch for any updates from Nasdaq regarding future plans for TON Strategy, as these could provide critical insights into market direction. 📮 Takeaway Monitor TON Strategy’s price action closely; a bounce from current support levels could signal a buying opportunity, while failure to recover may lead to further declines.

Balancer Exploited for $128 Million Across Ethereum Chains as Berachain Halts Network

Some $128 million in crypto was stolen from Balancer liquidity pools on Ethereum and beyond, with Berachain halting its chain as a result. 🔗 Read Full Article 💡 DMK Insight The $128 million theft from Balancer liquidity pools is a stark reminder of the vulnerabilities in DeFi. For traders, this incident could trigger increased volatility in Ethereum and related assets, especially as Berachain halts its operations. Liquidity pools are crucial for market stability, and significant breaches can lead to a loss of confidence among investors. Watch for potential sell-offs in ETH, particularly if it dips below the $3,500 mark, which could signal further panic. Additionally, keep an eye on how other DeFi projects respond; if they tighten security measures, it might stabilize the market, but if they don’t, we could see a broader downturn. On the flip side, this could also present a buying opportunity for those looking to enter the market at lower prices. Just be cautious—monitor the sentiment and any regulatory responses that could follow. The next few days will be crucial in determining whether this incident leads to a sustained downturn or a quick recovery. 📮 Takeaway Watch for ETH to hold above $3,500; a drop below could signal increased selling pressure and further market instability.

US Bitcoin ETFs Lost $946 Million After Hawkish Tone From Fed

Solana funds surged with $421 million in fresh capital. Overall, crypto ETFs shed $360 million in assets. 🔗 Read Full Article 💡 DMK Insight Solana’s $421 million influx is a bullish signal, especially as crypto ETFs face outflows. This divergence highlights Solana’s growing appeal amidst broader market skepticism. With SOL currently at $165.74, traders should note that this capital influx could indicate strong institutional interest, potentially pushing the price higher. If SOL can break above recent resistance levels, it might attract more retail investors, especially given the overall bearish sentiment in crypto ETFs, which shed $360 million. However, it’s worth considering that while Solana is gaining traction, the broader market’s volatility could still impact its performance. Watch for SOL’s ability to maintain momentum in the coming days, particularly if it can hold above key support levels. If it dips below $160, that could trigger selling pressure, so keeping an eye on these levels is crucial. 📮 Takeaway Monitor SOL closely; a break above $170 could signal further upside, while a drop below $160 may prompt selling.

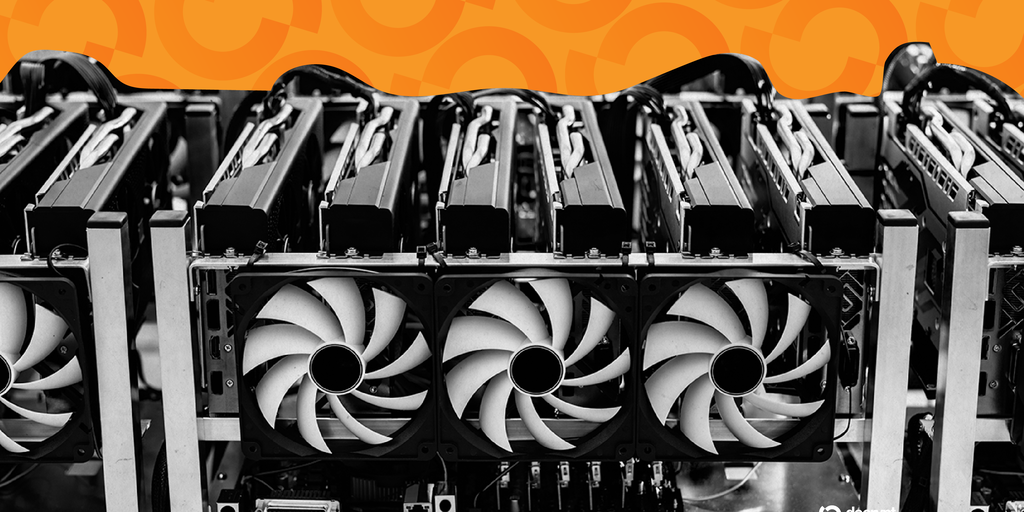

Bitcoin Miners IREN, Cipher Rise After Multi-Billion-Dollar Microsoft, Amazon Deals

The transactions are the latest between Magnificent Seven companies and Bitcoin miner and data center firms. 🔗 Read Full Article 💡 DMK Insight The ongoing transactions between the Magnificent Seven companies and Bitcoin miners signal a potential shift in market dynamics. These partnerships could lead to increased demand for mining infrastructure, which might drive up operational costs and influence Bitcoin’s price trajectory. As these tech giants engage with miners, they’re likely looking to secure more control over the supply chain, which could create a ripple effect across the crypto market, impacting everything from mining profitability to Bitcoin’s market cap. Traders should keep an eye on how these collaborations evolve, especially in terms of technological advancements and energy consumption. If these companies invest heavily in sustainable mining practices, it could change the narrative around Bitcoin’s environmental impact, attracting more institutional investors. Conversely, if operational costs rise without a corresponding increase in Bitcoin’s price, we could see a squeeze on miners, leading to potential sell-offs. Watch for any announcements regarding specific partnerships or investments, as these could serve as catalysts for price movements. Key levels to monitor include Bitcoin’s support and resistance zones, which will be influenced by these developments. 📮 Takeaway Keep an eye on partnerships between tech giants and Bitcoin miners; they could impact Bitcoin’s price and mining profitability significantly.

ArXiv Blocks AI-Generated Survey Papers After 'Flood' of Trashy Submissions

Preprint repository ArXiv is cracking down on survey papers after AI tools make it easy to mass-produce low-quality submissions that overwhelm volunteer moderators. 🔗 Read Full Article 💡 DMK Insight ArXiv’s crackdown on low-quality survey papers is a big deal for researchers and traders alike. This move signals a shift in how academic credibility is maintained, especially as AI-generated content floods the market. For traders, especially those in tech and AI sectors, this could impact the flow of reliable research and insights that drive investment decisions. If ArXiv’s moderation becomes stricter, we might see a decline in the quantity of new research, which could slow down innovation cycles in AI and related fields. On the flip side, this could create opportunities for high-quality research to stand out, potentially leading to better-informed trading strategies. Traders should keep an eye on how this affects the publication of significant AI advancements, as delays or reductions in credible research could lead to volatility in tech stocks. Watch for any shifts in sentiment around AI investments, particularly if major papers are delayed or rejected. This is a time to monitor the quality of research outputs closely, as they can significantly influence market movements in the tech sector. 📮 Takeaway Keep an eye on ArXiv’s policy changes; they could impact the quality of AI research and subsequently affect tech stock volatility.

AI Browsers Are Headed to Crypto—Donut Labs Just Raised $22 Million to Build It First

Donut Labs says its AI-powered browser can analyze markets and execute trades on its own. 🔗 Read Full Article 💡 DMK Insight AI trading tools are gaining traction, and here’s why that matters for traders: The emergence of AI-powered platforms like Donut Labs could redefine how trades are executed. These systems promise to analyze market conditions and execute trades autonomously, potentially increasing efficiency and reducing emotional decision-making. For day traders and swing traders, this could mean faster execution times and the ability to capitalize on fleeting opportunities. However, it’s crucial to remain skeptical. Automated systems can amplify volatility, especially in unpredictable markets. Traders should keep an eye on how these AI tools perform in real-time, particularly during high-impact news events or market shifts. Watch for any significant price movements in correlated assets, as AI trading could lead to cascading effects across markets. If these tools start gaining market share, we might see a shift in trading strategies, with more reliance on algorithmic trading. Keep an eye on performance metrics and user feedback from these platforms to gauge their effectiveness and reliability in live trading scenarios. 📮 Takeaway Monitor the performance of AI trading tools like Donut Labs, especially during volatile market conditions, to gauge their impact on trading strategies and execution.

Ripple Acquires Crypto Wallet and Custody Firm Palisade

Fintech firm Ripple made another acquisition, this time snatching up wallet provider and custody firm Palisade on Monday. 🔗 Read Full Article 💡 DMK Insight Ripple’s acquisition of Palisade could signal a strategic pivot in their custody solutions, and here’s why that matters: This move comes at a time when institutional interest in crypto custody is surging, driven by regulatory clarity and the need for secure asset management. By integrating Palisade’s technology, Ripple positions itself to capture a larger share of the growing demand for secure digital asset storage, especially among institutional investors. This could enhance Ripple’s value proposition, making it more attractive to potential partners and clients. However, it’s worth questioning whether this acquisition will lead to immediate revenue growth or if it’s more of a long-term play. The crypto market remains volatile, and while Ripple is making strides, it still faces significant competition from established players like Coinbase and Binance. Traders should keep an eye on Ripple’s price action, particularly if it approaches key resistance levels. Watch for any updates on how this acquisition impacts Ripple’s overall strategy and market position in the coming weeks. 📮 Takeaway Monitor Ripple’s price action around key resistance levels as the Palisade acquisition unfolds—this could influence institutional interest and market sentiment.

A Smarter Way to Talk to AI: Here's How to ‘Context Engineer’ Your Prompts

A team at Shanghai AI Lab says most AI errors stem not from bad models but from thin prompts. Their solution—“context engineering”—shows that giving language models richer background information leads to better results. 🔗 Read Full Article 💡 DMK Insight The focus on ‘context engineering’ in AI could reshape how traders analyze market sentiment and news. As SOL trades at $165.74, the implications of improved AI models could enhance predictive analytics, making it easier to interpret market movements. If AI can better parse complex financial data and sentiment, traders might find more reliable signals for entry and exit points. This is particularly relevant as we approach key market events like earnings reports or regulatory announcements, where nuanced understanding can lead to a significant edge. However, there’s a flip side: over-reliance on AI could lead to complacency. Traders should remain critical of AI-generated insights, especially in volatile markets where human intuition still plays a vital role. Watch for how AI advancements impact trading volumes and volatility in SOL and related assets, as these developments could create new trading opportunities or risks. 📮 Takeaway Keep an eye on how AI advancements in context engineering could influence SOL’s trading patterns, especially around upcoming market events.

Hollywood.com Reveals Crypto-Powered Prediction Market for Movies, TV and More

Fresh off its Trump Media deal for Truth Predict, Crypto.com reveals plans for entertainment prediction markets via Hollywood.com. 🔗 Read Full Article 💡 DMK Insight Crypto.com is making waves with its new entertainment prediction markets, and here’s why that matters right now: This move taps into the growing intersection of crypto and entertainment, potentially attracting a new demographic of users who are interested in both sectors. By leveraging its recent deal with Trump Media for Truth Predict, Crypto.com is positioning itself as a pioneer in a niche market that could see significant user engagement. Traders should keep an eye on how this initiative impacts Crypto.com’s user growth and trading volumes, as increased activity could lead to volatility in its token prices. Additionally, if this model proves successful, it could set a precedent for other crypto platforms to follow suit, further integrating digital assets into mainstream entertainment. But there’s a flip side: the regulatory landscape around prediction markets is still murky. If regulators step in, it could stifle innovation or create barriers to entry. Traders should monitor any news on regulatory responses, as this could impact market sentiment and trading strategies. Watch for key price levels on Crypto.com’s token and any spikes in trading volume as this news unfolds. 📮 Takeaway Keep an eye on Crypto.com’s token price and trading volume as the entertainment prediction market develops; regulatory news could create volatility.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano