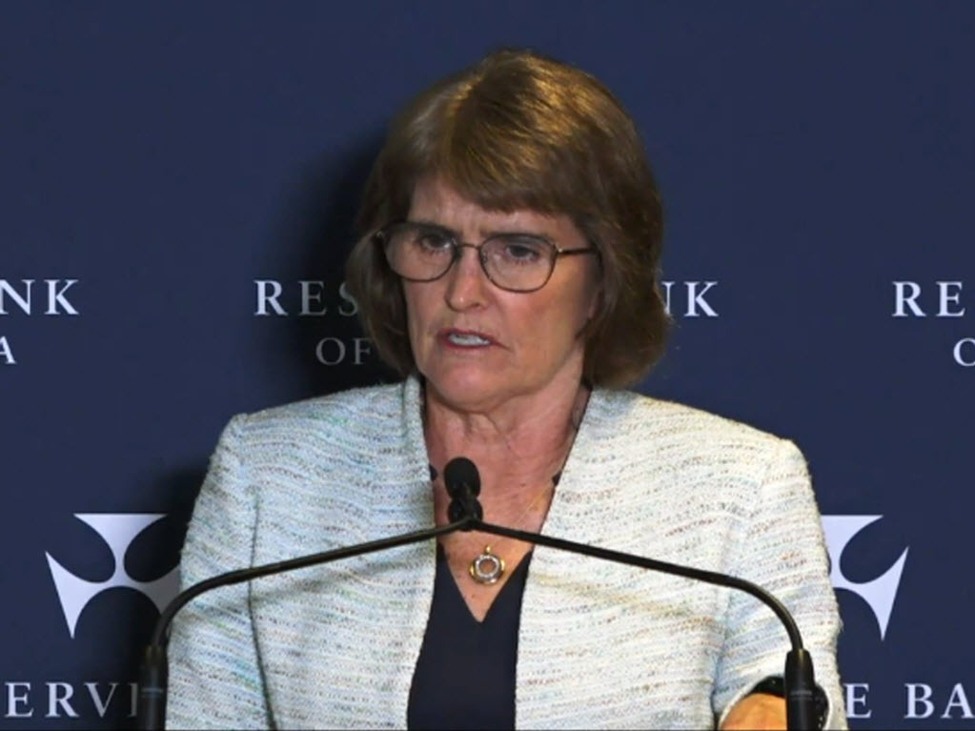

We’re alert to outside commentary on our policy settingThe board is not immune to outside commentary and will decide for themselves on policyPrevious rate cuts are still feeding through to the economyStill watching for the impact, it is a balancing actWe’ve already had three interest rate cuts, I know that mortgage holders want moreBut it’s also important to keep inflation under control, that’s also what impacts people’s living standardsPolicy is at the right spot at the momentI don’t think there’s anything else that would be too notable from her remarks. She has made it pretty clear that their current stance is to leave policy on hold and to weigh up economic data in the months ahead before deciding next year. AUD/USD is just holding marginally lower by 0.1% on the day at 0.6532, with the more negative risk mood likely to be the bigger driver today. This article was written by Justin Low at investinglive.com. 🔗 Read Full Article 💡 DMK Insight The central bank’s cautious stance on interest rates is crucial for traders right now. With three rate cuts already in the pipeline, the board’s ongoing assessment of economic impacts suggests volatility in both forex and equity markets. Traders should be particularly mindful of how these cuts influence consumer spending and inflation metrics, as they can shift market sentiment rapidly. If the board signals further cuts or maintains the current rates, expect significant reactions in currency pairs, especially those tied to the economy’s performance. Look for the USD to react strongly against major pairs like the EUR and JPY, depending on the next policy announcement. On the flip side, while rate cuts can stimulate growth, they also raise concerns about inflation if the economy overheats. This duality means traders need to monitor inflation indicators closely, as unexpected spikes could lead to a hawkish shift in policy. Keep an eye on key economic reports in the coming weeks, as they could provide critical insights into the board’s next moves. 📮 Takeaway Watch for the central bank’s next policy announcement; it could trigger volatility in major currency pairs, especially USD/EUR and USD/JPY.

Japan prime minister Takaichi says inflation yet to sustainably hit BOJ's price target

Japan still halfway through in achieving sustained achievement of BOJ price targetExpects BOJ to conduct appropriate monetary policy to sustainably hit price targetCalls on BOJ to work closely with the governmentAbenomics has boosted GDP, created jobsGovernment will strategically deploy fiscal spending to boost household income, consumer sentimentShe’s not being all too subtle about what she wants from the BOJ. And that solidifies her position and stance as the fiscal dove that she is, in wanting to push for her more expansionary agenda. This article was written by Justin Low at investinglive.com. 🔗 Read Full Article 💡 DMK Insight Japan’s struggle to meet the BOJ’s price target is a critical moment for traders: With the Bank of Japan (BOJ) still halfway to its inflation goal, traders should be on high alert. The call for the BOJ to align closely with government fiscal policies suggests a potential shift in monetary strategy. If the BOJ adjusts its stance, it could lead to significant volatility in the yen and related assets. Abenomics has had a positive impact on GDP and job creation, but without sustained inflation, the effectiveness of these measures may come into question. Traders should monitor the upcoming fiscal policies and any hints from the BOJ regarding interest rate adjustments. Key levels to watch include the USD/JPY pair, which could react sharply if the BOJ signals a more aggressive approach to achieving its inflation target. The interplay between monetary and fiscal policy could create opportunities, especially for those trading in forex or Japanese equities. Keep an eye on consumer sentiment indicators as they could provide insight into the effectiveness of these policies. 📮 Takeaway Watch for any BOJ policy shifts that could impact the USD/JPY pair; volatility is likely if they signal a change in strategy.

US futures look to reverse the start of the week gains on the day

The risk mood is feeling heavy after the AI-driven gains in Wall Street yesterday with today being pretty much a reversal of the moves to start the week. S&P 500 futures are now down 0.6% with Nasdaq futures down 0.8% on the day. Of note, Palantir shares rose by over 3% overnight but traded down over 5% in after hours despite its earnings beat.For earnings today, some big names will include AMD, Shopify, and Spotify. For the month itself, the big one to watch will be Nvidia’s earnings release but that will only come in about two more weeks on 19 November. This article was written by Justin Low at investinglive.com. 🔗 Read Full Article 💡 DMK Insight The market’s shift today signals a potential reversal in sentiment, and here’s why that matters: After a strong AI-driven rally, the S&P 500 and Nasdaq futures are both down, indicating a cooling off period that traders need to watch closely. This pullback could be a sign of profit-taking or a broader risk-off sentiment as investors reassess their positions. For day traders, this might mean tightening stop-loss orders or considering short positions, especially if the downward momentum continues. Keep an eye on key support levels; if the S&P 500 breaks below its recent lows, it could trigger further selling. Also, the rise in Palantir shares amidst this downturn is interesting. It suggests that while the broader market is struggling, certain stocks can still attract interest, possibly due to specific catalysts or earnings expectations. Traders should monitor Palantir closely for any signs of divergence from the overall market trend, as it could present unique trading opportunities. Watch for the next few days to see if this trend holds or if the market finds its footing again. 📮 Takeaway Watch the S&P 500 for a break below recent lows; a sustained downtrend could signal further market weakness.

We Are Traders: Hola Prime’s New Brand Campaign Puts Traders First Worldwide

London, October 2025 – Hola Prime, one of the world’s fastest-growing global trading companies, has launched its boldest brand campaign yet: “We Are Traders.” More than a marketing push, this campaign is a global movement to honor traders, reshape perceptions, and unite a community often overlooked in mainstream recognition.In a world where professions like technology, medicine and education are celebrated, trading rarely commands the same admiration. This is despite the extraordinary skill it demands. With “We Are Traders,” Hola Prime is changing that narrative. This campaign celebrates trading not just as a profession but as an identity, a discipline and a way of life.“Trading isn’t just what we do, it’s who we are,” said Himanshu Chandel, Marketing Director at Hola Prime. “Hola Prime is built by traders who understand the markets and the challenges traders face throughout their journey. With our ‘We Are Traders’ campaign, we are reaffirming that Hola Prime is not just a prop firm providing capital. We are traders ourselves, building solutions for traders’ challenges that were long ignored by the rest.”The campaign shines a spotlight on the extraordinary blend of skills traders master daily. These include technical analysis, mathematics, behavioral science, risk management and relentless discipline. By highlighting these, Hola Prime seeks to reposition trading as one of the most dynamic, demanding and rewarding pursuits of our time.Founded by Somesh Kapuria, a financial expert with decades of market experience, Hola Prime has consistently redefined what traders can expect from a prop firm. From 1-hour payouts and daily price transparency reports to trader-first rules, Hola Prime has turned long-standing industry frustrations into solutions. This has been possible only because Hola Prime was created by traders, people who share the same journey.The “We Are Traders” campaign will roll out across LATAM, MENAT, Asia, the U.S. and Europe beginning November 2025. It will feature cinematic digital films, powerful social storytelling and real trader narratives from across the globe. Designed as a cultural movement and a brand statement, it aims to inspire pride, unite the trading community and ensure that from Wall Street to home offices, traders everywhere can boldly say: “We Are Traders.”For campaign updates, visit www.holaprime.com or follow the global conversation at #WeAreTraders.About Hola PrimeHola Prime is a leading global proprietary trading firm with a strong presence in the UK, Hong Kong, Cyprus, Dubai, and India. Renowned for its commitment to transparency, Hola Prime serves prop traders across 175+ countries, offering access to multiple trading instruments. The firm is dedicated to empowering traders with real-time risk management, advanced technological infrastructure, and a secure trading environment. Committed to fairness and trust, Hola Prime ensures seamless payouts, robust compliance, and a reliable trading experience. With multiple trading platforms and a focus on bringing freshness to the prop trading industry, Hola Prime is redefining the future of trading. This article was written by IL Contributors at investinglive.com. 🔗 Read Full Article 💡 DMK Insight The launch of Hola Prime’s “We Are Traders” campaign is more than just a marketing gimmick; it signals a shift in how trading communities are perceived and valued. This initiative could foster greater engagement among traders, potentially leading to increased trading volumes and market activity. As traders often feel marginalized, a campaign that unites them could create a more vibrant trading ecosystem, encouraging collaboration and shared insights. However, it’s worth considering whether this movement will translate into tangible benefits for traders or if it’s merely a branding exercise. If traders respond positively, we might see a spike in retail participation, which could influence market volatility. Keep an eye on trading volumes and sentiment indicators over the next few weeks to gauge the campaign’s impact. If volumes increase significantly, it could signal a bullish trend across various assets, especially in sectors that align with the campaign’s message. Watch for any shifts in social media sentiment and engagement metrics as traders rally around this initiative, as these could provide early signals of market movements. 📮 Takeaway Monitor trading volumes and sentiment indicators over the next few weeks to assess the impact of Hola Prime’s “We Are Traders” campaign on market activity.

Unlocking Festive Rewards This Black Friday with PU Prime’s Copy Trading feature

As the year’s busiest shopping season approaches, PU Prime, a global multi-licensed online brokerage, joins the excitement of both shoppers and investors with the launch of its Black Friday Copy Trading campaign running from 3 to 30 November 2025.This season is not only exciting for shoppers to get their hands on major purchases, but it’s also one to look forward to by investors and traders. Echoing this enthusiasm, PU Prime is introducing a low-entry-threshold trading campaign designed to encourage trading participation and reward active engagement throughout the festive period.PU Prime is introducing its Black Friday Copy Trading campaign.During the campaign, eligible participants, including both copiers and signal providers, can qualify by completing just 0.5 lots of trading per week and holding each position for at least 5 minutes. Traders will then be eligible to receive a weekly mystery box voucher as a token of appreciation for their trading activity.Each mystery box gives participants the chance to receive a 10% deposit rebate voucher, with rebate values of up to USD 50, capped at USD 200 throughout the entire campaign period. Under PU Prime’s Copy Trading feature, beginners are empowered to diversify their portfolios and earn commissions through a simplified trading strategy. The system revolves around two main roles: Signal Providers and Copiers.Signal Providers are experienced traders who share their portfolios publicly for others to copy, earning a profit share in return. Meanwhile, Copiers replicate the real-time trades of Signal Providers, allowing them to participate in the markets without the need for hands-on trading decisions. Together, both groups form a collaborative trading community where everyone benefits from shared expertise and market participation.Through its Black Friday initiative, PU Prime once again underscores its commitment to innovation, accessibility, and trader empowerment, offering a festive season filled with opportunities and rewards for traders around the world.About PU PrimeFounded in 2015, https://www.puprime.com/forex-trading-account is a leading global fintech company providing innovative online trading solutions. Today, it offers regulated financial products across various asset classes, including forex, commodities, indices, and shares. With a presence in over 190 countries and more than 40 million app downloads, PU Prime is committed to enabling financial success and fostering a global community of empowered traders.For media enquiries, users can contact: media@puprime.com This article was written by IL Contributors at investinglive.com. 🔗 Read Full Article 💡 DMK Insight With PU Prime launching its Black Friday Copy Trading campaign, traders should pay attention to how this could influence market sentiment and trading volumes. The timing is crucial as it coincides with the busiest shopping season, which historically sees increased retail activity and can lead to heightened volatility in forex and crypto markets. Traders might want to consider how consumer spending trends could impact currency pairs, especially those tied to retail-heavy economies. Additionally, the campaign could attract new retail investors into the market, potentially driving up trading volumes and creating opportunities for day traders. However, it’s worth noting that increased participation can also lead to more erratic price movements, so keeping an eye on key technical levels during this period is essential. Watch for any significant price breaks or reversals in major pairs as the campaign unfolds, particularly around the end of November when trading dynamics may shift significantly due to holiday sentiment. 📮 Takeaway Monitor trading volumes and volatility in forex and crypto markets during PU Prime’s Black Friday campaign, especially around key technical levels in late November.

FX option expiries for 4 November 10am New York cut

There is just one to take note of on the day, as highlighted in bold below.That being for EUR/USD at the 1.1525 level. It’s not one that ties to any technical significance but could just play a part in holding price action a little, though the downside momentum since last week remains very much intact. As such, I don’t see the expiries having all too much impact especially with the risk mood looking fairly nervous and defensive ahead of European trading today.The rejection of the 100-day moving average continues alongside the break of the October low of 1.1542, allowing for the downside momentum to stretch further for now. The end July lows near 1.1400 will be a key target to watch on any continuation of that.For more information on how to use this data, you may refer to this post here.Head on over to investingLive (formerly ForexLive) to get in on the know! This article was written by Justin Low at investinglive.com. 🔗 Read Full Article 💡 DMK Insight EUR/USD is hovering around 1.1525, and here’s why that matters right now: While this level doesn’t have strong technical significance, it could act as a psychological barrier for traders. The recent downside momentum suggests that sellers are still in control, and if the pair breaks below this level, we could see a swift move toward lower support levels. Keep an eye on broader market sentiment, especially with upcoming economic data releases that could influence the Euro or the Dollar. If the pair fails to hold at 1.1525, it might trigger stop-loss orders, leading to increased volatility. On the flip side, if we see a bounce off this level, it could indicate a temporary retracement, but traders should be cautious about getting too bullish without confirmation. Watch for any shifts in momentum indicators or news that could impact the Eurozone or U.S. economic outlook, as these could provide clearer signals for positioning in the coming days. 📮 Takeaway Watch the 1.1525 level closely; a break below could accelerate downside momentum, while a bounce might signal a short-term retracement.

ECB's Rehn: Uncertainty about future economic developments remains high

The balance of risks are skewed to the downsideThe ECB continues to put forth a more guarded communique as essentially, they remain sidelined at least until the turn of the year. This article was written by Justin Low at investinglive.com. 🔗 Read Full Article 💡 DMK Insight With ETH at $3,501.16, traders need to brace for potential downside risks as the ECB signals a cautious stance. The European Central Bank’s reluctance to act until at least the new year suggests that monetary policy will remain tight, which could weigh on risk assets, including cryptocurrencies like Ethereum. If the market interprets this as a sign of economic weakness, we might see ETH testing lower support levels. Keep an eye on the $3,400 mark; a breach could trigger further selling pressure. On the flip side, if ETH manages to hold above this level, it could indicate resilience and attract buyers looking for a dip. However, the broader sentiment is likely to remain bearish until we get clearer signals from the ECB or other economic indicators. Watch for any shifts in trading volume or sentiment that could signal a reversal or confirmation of the downtrend. 📮 Takeaway Monitor ETH closely around the $3,400 support level; a break below could lead to increased selling pressure.

SNB's Tschudin: We will only use negative rates when necessary

We are keeping interest rates low, so that inflation remains in range of price stability (target range 0-2%)Our interest rates are where they should beWhether the Franc is correctly valued, overvalued or not is not decisive for our monetary policyWhat is important is how the exchange rate changes and its effect on inflationWe are not in situation where we would like to see lower inflationThe inflation forecast is where we want it (0.4% on average for Q4 2025)FX interventions are possibleThis is a pushback against negative rates speculations after yesterday’s soft Swiss CPI report. We’ve already heard many times the SNB members pushing back on negative rates as the bar for going back into NIRP (negative interest rate policy) remains very high. This article was written by Giuseppe Dellamotta at investinglive.com. 🔗 Read Full Article 💡 DMK Insight With ETH at $3,501.16, low interest rates are keeping crypto markets buoyant, but traders need to watch for volatility as inflation concerns linger. The current monetary policy aims to maintain inflation within a target range of 0-2%, which could influence investor sentiment in the crypto space. Low rates typically support risk assets like Ethereum, but if inflation starts to creep up, we could see a shift in the market. Traders should be cautious about potential corrections, especially if ETH approaches key resistance levels. If ETH breaks above $3,600, it could trigger further buying, but a drop below $3,400 may signal a bearish trend. It’s also worth noting that the broader forex market could react to any changes in the Franc’s valuation, impacting cross-asset correlations. Keep an eye on economic indicators that could affect interest rates, as these will likely ripple through to crypto markets. The next few weeks could be pivotal, especially with inflation data on the horizon. 📮 Takeaway Watch for ETH to break $3,600 for bullish momentum, but be cautious of a drop below $3,400 as a potential bearish signal.

USDJPY Technical Analysis: Is verbal intervention enough to stop yen slide?

Fundamental OverviewThe USD remains strong across the board following the hawkish turn from Fed Chair Powell last week. The repricing in interest rate expectations acted as a tailwind for the greenback as Treasury yields rose and continue to trade at the recent highs. Yesterday, we got a slightly weaker than expected ISM Manufacturing PMI report. Businesses continue to blame the tariff policy. Maybe the October US-China trade war weighed a bit on sentiment, so we will see if next month’s report shows the same downbeat mood. On the JPY side, the currency has been weakening since last week’s BoJ policy decision where the central bank left interest rates unchanged as expected with again two dissenters voting for a hike. There were no surprises but Governor Ueda focusing on spring wage negotiations suggested that the next hike could be delayed to January or even March 2026. Today, the yen strengthened across the board following some verbal intervention from the Japanese Finance Minister. This is generally just short-term stuff that provides pullbacks for traders.USDJPY Technical Analysis – Daily TimeframeOn the daily chart, we can see that USDJPY broke above the key resistance around the 153.27 level and now pulled back to retest it following the Japanese verbal intervention. This is where we can expect the buyers to step in with a defined risk below the 153.27 level to position for a rally into the 156.00 handle next. The sellers, on the other hand, will want to see the price breaking lower to start targeting the 151.00 support zone. USDJPY Technical Analysis – 4 hour TimeframeOn the 4 hour chart, we can see more clearly the pullback into the 153.27 level. We can see that we have also an upward trendline defining the upward momentum. If the price extends the drop past the 153.27 level, we can expect the buyers to lean on the trendline with a defined risk below it to keep pushing into new highs. The sellers, on the other hand, will look for a break lower to increase the bearish bets into the 151.00 support next.USDJPY Technical Analysis – 1 hour TimeframeOn the 1 hour chart, there’s not much else we can here as the buyers will likely pile in around the 153.27 level and the trendline to keep targeting new highs, while the sellers will look for downside breaks to push into new lows. The red lines define the average daily range for today.Upcoming CatalystsTomorrow we have the US ADP report and the US ISM Services PMI. On Thursday, we get the Japanese wage growth data. On Friday, we conclude the week with the US University of Michigan Consumer Sentiment report.Video This article was written by Giuseppe Dellamotta at investinglive.com. 🔗 Read Full Article 💡 DMK Insight The USD’s strength is a direct response to the Fed’s hawkish stance, and here’s why that matters for traders right now: With interest rate expectations shifting, the greenback is gaining momentum, pushing Treasury yields to recent highs. This environment typically favors USD-denominated assets, making it crucial for traders to monitor how this impacts forex pairs, especially those involving the EUR and JPY. If the USD continues to strengthen, it could lead to a bearish outlook for commodities priced in dollars, like gold and oil. Traders should keep an eye on key technical levels; for instance, if the USD index breaks above a certain resistance level, it could trigger further buying pressure. On the flip side, a strong USD might not be sustainable if economic data starts to show signs of weakness. If upcoming reports reveal a slowdown, we could see a rapid reversal. So, while the current trend favors the dollar, be prepared for potential volatility as market sentiment shifts. Watch for upcoming economic indicators that could sway interest rate expectations and impact the dollar’s trajectory. 📮 Takeaway Monitor the USD index closely; a break above key resistance could signal further strength, impacting forex pairs and commodities significantly.

European indices off to a rough start to the day

Eurostoxx -1.4%Germany DAX -1.5%France CAC 40 -1.4%UK FTSE -0.8%Spain IBEX -1.6%Italy FTSE MIB -1.2%Major indices in the region are down over 1% at the open to start with. Ouch. The negative mood comes as US futures are also bleeding badly with S&P 500 futures down 1.1% with tech shares leading losses as Nasdaq futures are down 1.4%. That’s putting a more risk averse mood to broader markets with the Japanese yen holding firmer as the aussie and kiwi sag in the major currencies space. This article was written by Justin Low at investinglive.com. 🔗 Read Full Article 💡 DMK Insight European markets are feeling the heat, and here’s why that matters: a 1% drop across major indices signals growing investor anxiety. With the DAX down 1.5% and the CAC 40 following closely, traders should be wary of potential cascading effects. The negative sentiment is mirrored in US futures, particularly the S&P 500, which is down 1.1%, indicating that tech shares are leading the charge in this downturn. This could suggest a broader risk-off sentiment that might spill over into other asset classes. Watch for key support levels in the DAX around recent lows; a break below could trigger further selling pressure. Keep an eye on the correlation with tech stocks, as their performance could dictate the pace of recovery or further decline in European markets. Here’s the thing: while the immediate outlook looks grim, it could also present buying opportunities if prices reach attractive support levels. But be cautious—volatility is likely to remain high in the short term, so monitor the market closely for any signs of stabilization or further deterioration. 📮 Takeaway Watch the DAX for key support levels; a break below could lead to increased selling pressure across European markets.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Wrapped SOL

Wrapped SOL  USDC

USDC  TRON

TRON  Lido Staked Ether

Lido Staked Ether  Dogecoin

Dogecoin