Secretary Scott Bessent said the negotiations alleviate the need for the 100% additional tariffs announced by US president Trump in October. 🔗 Read Full Article 💡 DMK Insight Negotiations easing tariff tensions could shift market sentiment significantly. With Secretary Scott Bessent’s comments, traders should consider how this impacts sectors sensitive to tariffs, like manufacturing and agriculture. If the 100% additional tariffs are indeed off the table, it could lead to a bullish sentiment in these sectors, potentially driving up stock prices and improving investor confidence. Keep an eye on related ETFs and stocks that could benefit from this news. However, it’s worth questioning the durability of these negotiations. If the talks falter, we could see a quick reversal in market sentiment. Watch for any updates or statements from the White House that could signal a change in direction. For now, focus on key levels in affected stocks and sectors, particularly those that have been under pressure due to tariff fears. A break above recent resistance levels could indicate a strong bullish trend. 📮 Takeaway Monitor developments in tariff negotiations closely; a positive outcome could lead to bullish moves in sensitive sectors, especially if key resistance levels are broken.

The next era of crypto belongs to decentralized markets

DeFi trading volumes hit record ratios against CEXs as matured infrastructure and regulatory clarity shift power to transparent, code-driven platforms. 🔗 Read Full Article 💡 DMK Insight DeFi trading volumes are surging, and here’s why that matters: as decentralized finance platforms gain traction, traders need to rethink their strategies. The shift from centralized exchanges (CEXs) to decentralized exchanges (DEXs) indicates a growing trust in blockchain technology and a desire for transparency. This trend could lead to increased volatility in CEXs as liquidity shifts, potentially impacting trading strategies that rely on traditional platforms. Traders should monitor the ratio of DeFi to CEX volumes closely, as a continued rise could signal a fundamental shift in market dynamics. However, it’s worth noting that while DeFi offers advantages like lower fees and enhanced privacy, it also comes with risks such as smart contract vulnerabilities. Traders should remain cautious and consider diversifying their portfolios to include both DeFi and CEX assets. Keep an eye on key metrics like transaction volumes and liquidity pools in DeFi, as these will be critical indicators of where the market is heading. 📮 Takeaway Watch the DeFi to CEX volume ratio closely; a continued rise could indicate a major shift in trading dynamics, impacting your strategies.

“Coinbase CEO Reveals Onchain Startup Lifecycle Transition Plans: A Paradigm Shift in Capital Formation”

📰 DMK AI Summary Coinbase CEO Brian Armstrong revealed plans to transition the entire startup lifecycle onto the blockchain, including incorporation, fundraising, and public trading. Armstrong believes that onchain fundraising could streamline the capital formation process by making it more efficient, fair, and transparent. With the recent acquisition of fundraising platform Echo, Coinbase aims to facilitate instant capital raising through smart contracts, eliminating the need for traditional intermediaries like banks and lawyers. 💬 DMK Insight Armstrong’s vision for an onchain startup lifecycle signifies a potential paradigm shift in how companies raise capital and go public. By leveraging blockchain technology, Coinbase seeks to democratize access to funding opportunities, ultimately fostering innovation and growth in the startup ecosystem. This move could disrupt traditional fundraising methods and empower entrepreneurs to navigate the financing landscape more effectively. 🧾 Editorial Note This article was automatically summarized and analyzed by DMK News Bot’s AI System, using publicly available data and verified financial updates.

Betting Scandals Are Rocking Sports. Will Prediction Markets Help or Hurt?

Government regulators and legal experts warn that insider trading could proliferate in professional sports as wagers migrate to prediction markets. 🔗 Read Full Article 💡 DMK Insight Insider trading risks in sports betting are rising, and here’s why traders need to pay attention: As prediction markets gain traction, the potential for insider trading could disrupt not just sports betting but also related financial markets. If regulators tighten their grip, we might see volatility in stocks associated with sports franchises or betting companies. Traders should be wary of how this could impact market sentiment and stock prices, especially for firms heavily invested in sports betting. Look for key indicators like regulatory announcements or shifts in betting volumes that could signal market reactions. On the flip side, while some may see this as a threat, it could also create opportunities for savvy traders who can navigate the regulatory landscape. Keeping an eye on how major betting companies respond to these warnings will be crucial. Watch for any significant price movements in stocks like DraftKings or FanDuel, particularly if they face increased scrutiny or legal challenges in the coming weeks. 📮 Takeaway Monitor regulatory developments around insider trading in sports betting; significant moves in stocks like DraftKings could signal broader market impacts.

Alibaba’s Qwen Deep Research Creates Live Webpages, Podcasts in Seconds

Alibaba’s Qwen Deep Research now converts reports into live webpages and podcasts with one click. Here’s how the free service compares to Gemini, ChatGPT, and Grok. 🔗 Read Full Article 💡 DMK Insight Alibaba’s new Qwen Deep Research tool is a game changer for content consumption, and here’s why that matters: it could shift how traders access and analyze market data. By converting reports into live webpages and podcasts instantly, this service enhances the speed at which information is disseminated. In a market where timing is everything, having immediate access to insights can give traders a crucial edge. This could particularly benefit day traders who thrive on real-time data and analysis. If Alibaba’s tool gains traction, it might pressure competitors like ChatGPT and Gemini to innovate further, potentially leading to a more dynamic trading environment. But there’s a flip side—over-reliance on automated insights could lead to herd behavior, where traders react to the same information simultaneously, increasing volatility. Keep an eye on how this tool influences trading patterns and sentiment in the coming weeks. Watch for any shifts in engagement metrics or user adoption rates, as these could signal broader market trends. 📮 Takeaway Monitor how Alibaba’s Qwen Deep Research tool impacts trading sentiment and data consumption, especially among day traders, in the next few weeks.

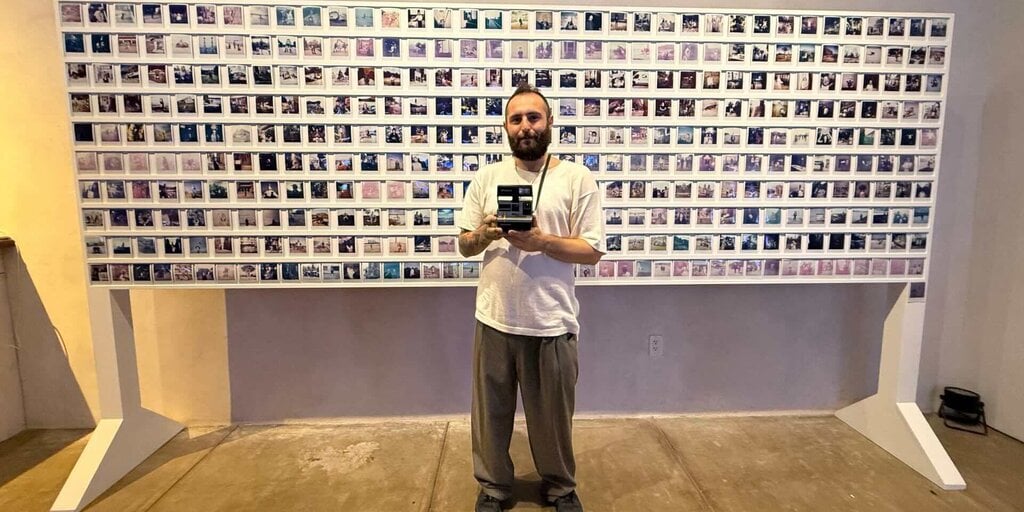

'Moments of the Unknown': Justin Aversano Shares Globetrotting Love Letter to Humanity

From New York to Antarctica, Justin Aversano’s latest work is a journey across continents, cultures, and the human heartbeat. 🔗 Read Full Article

North Korea Has Stolen Billions in Crypto, But the Ability to 'Fight Back Is Growing': Chainalysis

The sanctioning of the DPRK IT worker network and recovery of Bybit funds are signs of the growing pushback, experts told Decrypt. 🔗 Read Full Article 💡 DMK Insight The recent sanctions on the DPRK IT worker network and the recovery of Bybit funds highlight a significant shift in regulatory enforcement, and here’s why that matters right now: Traders should be aware that these developments indicate a tightening grip on illicit crypto activities, which could lead to increased volatility in the market. As authorities ramp up their efforts, we might see a ripple effect on exchanges that could face scrutiny, impacting liquidity and trading strategies. If you’re holding positions in assets that have been associated with regulatory risks, now’s the time to reassess your exposure. Keep an eye on how major exchanges respond to these sanctions, as their compliance measures could influence market sentiment and trading volumes in the coming weeks. On the flip side, this crackdown could also create opportunities for compliant projects that stand to gain from the market’s flight to safety. Watch for any price reactions in major cryptocurrencies as traders digest this news and adjust their strategies accordingly. Key levels to monitor include support and resistance zones that could be tested as the market reacts to regulatory news. 📮 Takeaway Traders should monitor major exchanges’ responses to the DPRK sanctions, as compliance measures could impact liquidity and create volatility in the coming weeks.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Wrapped SOL

Wrapped SOL  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin