Ether’s mega whales are quietly buying the dips, absorbing supply from smaller holders during the price drop. 🔗 Read Full Article 💡 DMK Insight Ether’s mega whales are stepping in, and here’s why that matters: With ETH currently at $3,854.72, the accumulation by large holders indicates a potential floor forming in this price range. This behavior often signals confidence in the asset’s long-term value, especially during dips. Smaller holders selling off could create a temporary supply shock, but as whales absorb this supply, it may set the stage for a rebound. Traders should keep an eye on the volume and price action in the coming days. If ETH can hold above $3,800, it might attract more buying interest, while a drop below could trigger further selling. But here’s the flip side: if these whales are merely positioning for a short-term trade, we could see volatility spike as they offload their positions. Watch for key resistance around $4,000; if ETH can break through that, it could signal a stronger bullish trend. Conversely, if the price falters, it may indicate that the market isn’t ready for a sustained rally yet. Keep an eye on whale activity and market sentiment as we head into the weekend. 📮 Takeaway Monitor ETH’s ability to hold above $3,800; a break above $4,000 could signal a bullish trend, while a drop below may lead to increased volatility.

Ledger's Latest Nano Crypto Hardware Wallet Offers a Punch of Personality

The Ledger Nano Gen5 is totally redesigned and features exclusive badges from legendary Apple icon designer, Susan Kare. 🔗 Read Full Article

Morning Minute: Crypto Caught in Middle of Democrat vs Republican Battle

It’s getting heated in DC, and the crypto industry is stuck in the middle—perhaps a sign of what’s to come as it becomes more politicized. 🔗 Read Full Article 💡 DMK Insight The political climate in Washington is heating up, and crypto is caught in the crossfire. This isn’t just a passing trend; it signals a shift towards increased regulation and scrutiny, which could reshape trading strategies. As lawmakers debate the future of digital assets, traders need to brace for potential volatility. Regulatory news often leads to sharp price movements, and with BTC at $62,300 and ETH at $2,200, any unfavorable legislation could trigger sell-offs or panic buying. Look at the broader market context: if major regulations are enacted, we could see a ripple effect across related assets, including altcoins and DeFi projects. Traders should keep an eye on key support and resistance levels—if BTC breaks below $60,000, it could signal a bearish trend, while a push above $65,000 might attract bullish momentum. The next few weeks are crucial; watch for any announcements from Congress that could impact market sentiment. 📮 Takeaway Monitor BTC’s support at $60,000 and resistance at $65,000 as political developments unfold—these levels could dictate short-term trading strategies.

Solana Company Ramps Up Staking Push With Institutional Validators as Shares Tumble

Even as its shares plunge, Solana Company says market volatility is a chance to prove conviction in its Solana-based treasury model. 🔗 Read Full Article 💡 DMK Insight Solana’s recent plunge to $191.44 is a critical moment for traders to assess its treasury model’s resilience. The company’s assertion that market volatility presents an opportunity is intriguing, but it raises questions about the sustainability of its treasury strategy. With the crypto market still reeling from macroeconomic pressures, traders should be cautious. If Solana can maintain its price above key support levels, it might attract buyers looking for a bargain. However, a sustained drop below $190 could trigger further selling pressure, impacting not just Solana but also correlated assets like ETH and BTC, which often move in tandem with market sentiment. Keep an eye on trading volumes and sentiment indicators; a spike in buying could signal a reversal, while increased selling could confirm bearish trends. Here’s the thing: while Solana’s treasury model could be a game-changer, the current volatility might mask underlying weaknesses. Watch for any updates from the company that could clarify their strategy moving forward, especially in the next few weeks as the market stabilizes. 📮 Takeaway Monitor Solana’s price action around $190; a break below could lead to increased selling pressure, while holding above may attract buyers.

Trezor Unveils 'Quantum-Ready' Safe 7 Hardware Wallet

Trezor said its new Safe 7 device anticipates a post-quantum future even as crypto thefts are set to hit record highs. 🔗 Read Full Article 💡 DMK Insight Trezor’s launch of the Safe 7 device is a strategic move amid rising crypto thefts, and here’s why that matters: With crypto thefts projected to reach unprecedented levels, security is top of mind for traders and investors. Trezor’s focus on a post-quantum future indicates they’re anticipating the next wave of technological threats, which could impact how assets are stored and secured. For traders, this means that investing in hardware wallets like the Safe 7 could become essential, especially as institutional interest in crypto grows. If larger players start adopting advanced security measures, it could create a ripple effect, pushing retail traders to follow suit. But there’s a flip side: while Trezor is positioning itself as a leader in security, the market’s reaction to such innovations can be unpredictable. Traders should keep an eye on how this device performs in the market and whether it gains traction among security-conscious investors. Watch for any shifts in market sentiment around crypto security, as this could influence related assets, particularly those tied to hardware wallet manufacturers or cybersecurity firms. Key metrics to monitor include sales figures for the Safe 7 and any partnerships Trezor may announce to bolster its security offerings. 📮 Takeaway Keep an eye on Trezor’s Safe 7 sales and market sentiment around crypto security; rising thefts could drive demand for secure storage solutions.

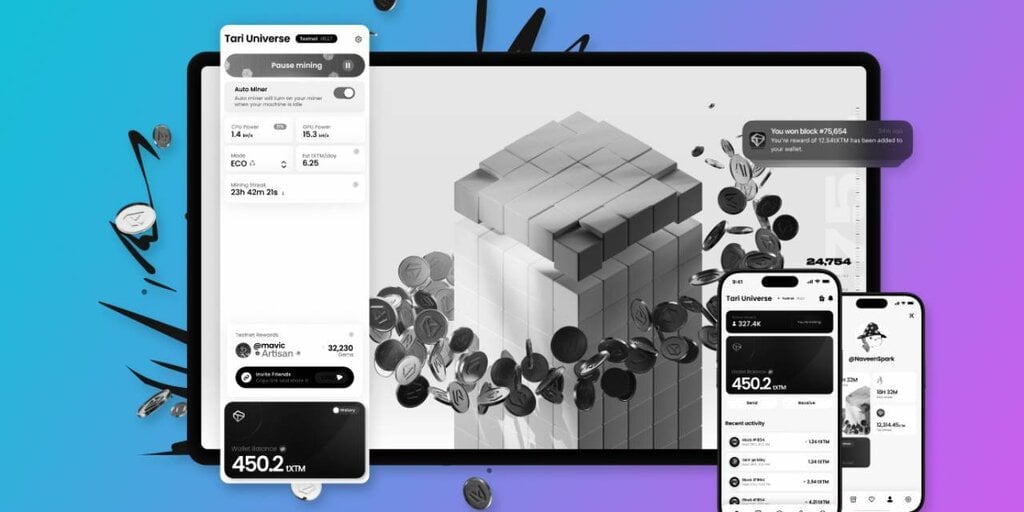

How Tari Lets You Mine Crypto in ‘Less Than a Minute’

The proof-of-work layer-1 is designed to make crypto mining accessible to mainstream users, contributor Naveen Jain explained. 🔗 Read Full Article 💡 DMK Insight Making crypto mining accessible to mainstream users could shift the market dynamics significantly. If more individuals can participate in mining, we might see an increase in hash rates, which could lead to greater network security and potentially influence the price of cryptocurrencies like Bitcoin. This democratization of mining could also attract retail investors who previously felt excluded from the mining process, creating a ripple effect in the market. However, there’s a flip side to this. Increased participation might lead to higher energy consumption and environmental concerns, which could prompt regulatory scrutiny. Traders should keep an eye on how this development affects mining profitability and the overall sentiment in the crypto space. If hash rates surge, it could indicate a bullish trend for Bitcoin, but watch for any regulatory news that could dampen enthusiasm. In the short term, monitor Bitcoin’s price action closely; if it holds above key support levels, it could signal a bullish continuation. Conversely, any negative regulatory news could lead to a sharp sell-off, so stay alert for updates. 📮 Takeaway Watch Bitcoin’s support levels closely; increased mining accessibility could lead to price volatility depending on regulatory responses.

The MegaETH interview (w/ Bread)

Crypto bounces as BTC dominance rises to 60%. The SEC and CFTC aim for crypto regulation by the end of 2025. Democrats and crypto executives meet to discuss a crypto bill. Over 150 crypto ETF filings await review. HYPE leads altcoins after its co-founder appeared on TBPN. Hyperliquid Strategies plans to raise $1b to buy HYPE. Aave DAO proposes a $50m annual token buyback. Robinhood officially lists BNB. FalconX acquires 21Shares. T. Rowe Price files for its first crypto ETF. Coinbase unveils a tool for AI agents to access wallets. HTX is sued by the UK for unlawful crypto promotion. Canada’s Cryptomus exchange is fined CAD 177m. Hackers move $1.8b BTC stolen from LuBian. Farage says he is willing to go to prison to stop the UK CBDC. Russia plans to legalise crypto use in foreign trade. 🔗 Read Full Article 💡 DMK Insight Bitcoin’s dominance hitting 60% is a big deal for traders right now. As BTC climbs to $110,060, it signals a potential shift in market sentiment, especially with altcoins reacting to the hype surrounding regulatory discussions and ETF filings. The SEC and CFTC’s push for crypto regulation by 2025 could bring much-needed clarity, but it also raises questions about how strict these regulations will be. Traders should keep an eye on how this affects liquidity and volatility across the board. If Bitcoin continues to gain dominance, altcoins may face pressure as capital flows back to BTC. Watch for key resistance levels around $115,000 for Bitcoin; a break above could trigger further bullish momentum. On the flip side, if altcoins can’t sustain their recent gains, we might see a consolidation phase. Keep tabs on the ETF filings—if any get approved, it could be a game changer for market sentiment and institutional interest. 📮 Takeaway Monitor Bitcoin’s resistance at $115,000; a breakout could signal further bullish momentum, while altcoins may struggle if BTC dominance continues to rise.

Trump Pardons Binance Founder Changpeng Zhao After Biden's 'War on Crypto'

U.S. President Donald Trump has pardoned Binance founder Changpeng “CZ” Zhao, the White House confirmed to Decrypt. 🔗 Read Full Article 💡 DMK Insight Trump’s pardon of Binance’s CZ could shake up market sentiment significantly. This unexpected move might signal a shift in regulatory attitudes towards crypto, potentially easing fears among traders about government crackdowns. If CZ’s legal troubles are behind him, it could restore confidence in Binance and its operations, possibly leading to increased trading volume and activity on the platform. Traders should keep an eye on BTC and ETH as they often react to news involving major exchanges. A bullish sentiment could push BTC above $63,000, while a failure to sustain momentum might lead to a pullback. However, there’s a flip side. This pardon could also attract scrutiny from regulators who may feel pressured to act more aggressively in the future. Watch for any statements from the SEC or CFTC in the coming days, as they could influence market direction. Overall, this is a pivotal moment for Binance and the broader crypto market, and traders should monitor price action closely over the next week. 📮 Takeaway Watch for BTC to break above $63,000 as sentiment shifts; any regulatory responses could change the game quickly.

Revolut Secures MiCA License in Cyprus—Is a Stablecoin Next?

An EU lawyer said the European banking giant is now ‘positioned to legally issue its own stablecoin,’ with a 2026 launch ‘plausible.’ 🔗 Read Full Article 💡 DMK Insight The potential for a European banking giant to launch its own stablecoin by 2026 is a game-changer for the crypto market. This move could legitimize stablecoins in the EU, attracting institutional interest and possibly influencing regulatory frameworks. Traders should keep an eye on how this development might affect existing stablecoins like USDT or USDC, especially if the new entrant offers competitive features or regulatory advantages. If the launch gains traction, it could also impact the broader crypto market, potentially leading to increased volatility in related assets. Watch for any updates on regulatory approvals or partnerships that could accelerate this timeline, as these will be key indicators of the stablecoin’s market reception and adoption. The real story here is how this could reshape the competitive landscape for stablecoins in Europe and beyond. 📮 Takeaway Monitor developments around the EU stablecoin launch, as regulatory shifts could impact existing stablecoins and related markets significantly.

Myriad Moves: Does Bitcoin Bounce Before 'Uptober' Ends, and Who Wins the World Series?

Top markets on Myriad this week include price predictions on Bitcoin and Ethereum, as well as chances the Dodgers win the World Series. 🔗 Read Full Article 💡 DMK Insight Ethereum’s current price at $3,854.72 is a critical level for traders to monitor. With ETH hovering near this mark, it’s essential to consider the broader market sentiment and potential resistance levels. If ETH can break above $4,000, we could see a surge in buying pressure, especially from institutional investors looking to capitalize on bullish momentum. Conversely, a drop below $3,700 might trigger stop-loss orders and lead to a cascade of selling, impacting not just ETH but also related assets like DeFi tokens. The real story here is how ETH’s performance could influence Bitcoin, which often follows Ethereum’s lead in market movements. Traders should keep an eye on the correlation between these two assets, especially as we approach key market events or announcements that could sway sentiment. Watch for volume spikes around these price levels to gauge market strength. 📮 Takeaway Monitor ETH closely at $3,854.72; a break above $4,000 could trigger significant buying, while a drop below $3,700 may lead to selling pressure.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether