Consumers deserve the choice to earn yield on stablecoins, not be boxed into earning interest only through banks, Kraken co-CEO Dave Ripley said. 🔗 Read Full Article 💡 DMK Insight Dave Ripley’s comments highlight a growing trend in the crypto space: consumers want alternatives to traditional banking for yield generation. This sentiment reflects a broader shift towards decentralized finance (DeFi) solutions, where stablecoins can offer attractive yields without the constraints of banks. Traders should keep an eye on platforms that facilitate stablecoin lending and yield farming, as these could see increased activity. If stablecoin yields rise, we might witness a shift in liquidity from traditional financial institutions to DeFi platforms, impacting both crypto and fiat markets. However, it’s worth noting that while consumers crave these options, regulatory scrutiny is tightening. Traders should monitor any developments in regulations that could affect stablecoin usage and yield opportunities, especially in the coming months as the market evolves. 📮 Takeaway Watch for shifts in liquidity towards DeFi platforms as stablecoin yields rise, but stay alert for regulatory changes that could impact these opportunities.

Asia’s stock exchanges are pushing back against crypto treasuries: Report

Top exchanges in Hong Kong, India and Australia are rejecting companies seeking to become crypto hoarders, citing shell company concerns. 🔗 Read Full Article 💡 DMK Insight Exchanges in Hong Kong, India, and Australia are tightening their grip on crypto hoarders, and here’s why that matters: This move reflects growing regulatory scrutiny, which could signal a shift in how crypto companies are perceived globally. Traders should be aware that this could lead to increased volatility in the market as companies scramble to comply or pivot their strategies. If these exchanges are rejecting applications, it might indicate a broader trend where regulators are less tolerant of companies that don’t meet stringent criteria, potentially affecting liquidity and investor confidence. Watch for how this impacts major cryptocurrencies, especially if it leads to a decline in trading volumes or market participation. On the flip side, while some might see this as a negative, it could also pave the way for more legitimate projects to thrive. If the market cleans up, it might attract institutional investors looking for safer bets. Keep an eye on the BTC and ETH price movements in response to these developments, especially if they approach key support levels. Monitoring regulatory announcements will be crucial in the coming weeks. 📮 Takeaway Watch for BTC and ETH price reactions as regulatory scrutiny increases; key support levels could be tested if trading volumes drop.

Retail crypto TXs have doubled on regulatory clarity: TRM Labs

Most crypto activity over the last year has been tied to practical use cases such as payments, remittances and preserving value in volatile economic conditions. 🔗 Read Full Article 💡 DMK Insight Crypto’s recent shift towards practical use cases is a game changer for traders. With BTC and ETH currently at $62,300 and $2,200 respectively, the focus on payments and remittances signals a maturation of the market. This trend could lead to increased adoption and stability, making these assets more attractive for long-term investors. Traders should keep an eye on transaction volumes and network activity as indicators of this shift. If BTC can hold above $60,000, it may attract more institutional interest, while ETH’s performance will be closely tied to developments in DeFi and NFTs. However, there’s a flip side: if economic conditions worsen, speculative trading could spike, leading to volatility. Watch for key support levels around $60,000 for BTC and $2,000 for ETH, as breaking these could trigger significant sell-offs. In the coming weeks, monitor how these practical use cases evolve and whether they can sustain momentum amid broader economic uncertainties. 📮 Takeaway Watch BTC’s support at $60,000 and ETH’s at $2,000; a break below could spark volatility amid shifting market dynamics.

Prediction markets hit new high as Polymarket enters Sam Altman’s World

World’s Polymarket Mini App integration came amid prediction markets surging past 2024 records, with $2 billion in weekly trading volumes. 🔗 Read Full Article 💡 DMK Insight Polymarket’s Mini App integration is a game changer, especially with prediction markets hitting $2 billion in weekly trading volumes. This surge signals a growing interest in decentralized betting and forecasting, which could attract both retail and institutional traders looking for new opportunities. As these markets gain traction, they might influence the broader crypto landscape, particularly assets tied to decentralized finance (DeFi) and gaming sectors. Traders should watch for potential volatility spikes in related tokens as more participants enter the fray. However, it’s worth questioning whether this volume increase is sustainable or just a temporary spike. If the hype fades, we could see a sharp correction. Keep an eye on key levels in related assets and be prepared for rapid shifts in sentiment. 📮 Takeaway Watch for how Polymarket’s integration impacts related DeFi tokens, especially if trading volumes remain high beyond the initial surge.

Open banking will keep America at the forefront of financial innovation

Open banking facilitates access to rural financial services and digital asset integration, but traditional banks pose potential restrictions. 🔗 Read Full Article 💡 DMK Insight Open banking’s push into rural areas is a game changer, but traditional banks might not play nice. The integration of digital assets into rural financial services could unlock new trading opportunities, especially for those looking to diversify. However, the potential pushback from traditional banks could create volatility as they may impose restrictions or slow down adoption. This tension could lead to a bifurcated market where digital assets thrive in rural settings while facing headwinds in urban areas. Traders should keep an eye on regulatory developments and any announcements from major banks regarding their stance on open banking and digital assets. Watch for how these dynamics play out over the next few months, especially as more rural institutions begin to adopt these technologies. If traditional banks start to clamp down, it could create a ripple effect, impacting not just local markets but also broader asset classes tied to digital finance. 📮 Takeaway Monitor regulatory news on open banking and traditional banks’ responses, as this could impact digital asset adoption and market volatility in the coming months.

UK cracks down: Hundreds of crypto exchanges hit with FCA warnings in Oct.

The Financial Conduct Authority renewed its warnings advising residents of the United Kingdom not to use unregistered crypto exchanges. 🔗 Read Full Article 💡 DMK Insight The FCA’s renewed warnings about unregistered crypto exchanges are a big deal for UK traders right now. With the crypto market’s volatility, many traders might be tempted to use these platforms for quick gains, but the risks are high. Unregistered exchanges can lead to loss of funds and lack of recourse. This could also trigger a broader regulatory crackdown, impacting liquidity and trading strategies across the board. If you’re trading BTC at $62,300 or ETH at $2,200, keep an eye on how these warnings affect market sentiment. Watch for potential sell-offs or shifts in trading volume as traders reassess their platforms. The real story here is how this could affect the legitimacy of the entire market in the UK, pushing more traders towards regulated options. As regulations tighten, monitor the response from major exchanges and how they adapt to maintain user trust. This could be a pivotal moment for compliance in the crypto space, so stay alert for any announcements from the FCA or major exchanges. 📮 Takeaway Watch for shifts in trading volume and sentiment as FCA warnings could lead to increased regulatory scrutiny and impact liquidity in the crypto market.

Congress moves to revamp Bank Secrecy Act’s reporting thresholds after 50 years

The STREAMLINE Act would update anti–money laundering rules by lifting decades-old thresholds for transaction reporting, cutting red tape for banks and crypto companies. 🔗 Read Full Article 💡 DMK Insight The STREAMLINE Act could reshape crypto compliance and trading dynamics significantly. By raising transaction reporting thresholds, banks and crypto firms might see reduced operational burdens, potentially leading to increased liquidity in the market. This is crucial right now as traders are navigating a landscape where regulatory clarity can influence price movements. If institutions feel less constrained, we could see a surge in institutional participation, which historically has led to bullish trends in crypto assets. However, there’s a flip side: while easing regulations might benefit liquidity, it could also attract scrutiny from regulators if illicit activities rise. Traders should keep an eye on how this legislation progresses and its impact on major assets like Bitcoin and Ethereum, especially if we see a spike in trading volumes. Watch for any price reactions around key levels—like BTC’s recent highs or ETH’s support zones—as these could signal broader market sentiment shifts following the Act’s implementation. 📮 Takeaway Monitor BTC and ETH for volatility around key support and resistance levels as the STREAMLINE Act progresses, particularly if institutional activity increases.

Crypto bill deliberation reaches fever pitch between industry execs and US lawmakers

The shutdown could stall progress on the crypto market structure bill, but lawmakers continue to insist the legislation is on track. 🔗 Read Full Article 💡 DMK Insight The potential government shutdown is a big deal for crypto legislation, and here’s why: it could delay the crypto market structure bill that’s been gaining traction. If lawmakers are serious about keeping this bill on track, they’ll need to navigate the shutdown’s impact on their schedules and priorities. A delay could lead to uncertainty in regulatory clarity, which often spooks investors and traders alike. This could create volatility in crypto assets, especially if traders react to the news by pulling back or reallocating their portfolios. Watch for how major players, like institutions and retail investors, respond in the coming days. If the bill gets stalled, it might trigger a sell-off, particularly in assets like BTC and ETH, which are sensitive to regulatory news. On the flip side, if the bill somehow progresses despite the shutdown, it could ignite a rally as traders rush to capitalize on the newfound clarity. Keep an eye on the legislative calendar and any updates from lawmakers, as these could serve as key indicators for market sentiment moving forward. 📮 Takeaway Monitor the legislative updates closely; a delay in the crypto market structure bill could lead to increased volatility in BTC and ETH prices.

EU sanctions Russian A7A5 stablecoin and crypto exchanges

Russian oil companies have been increasingly relying on digital assets and crypto platforms to circumvent financial sanctions, according to the European Commission. 🔗 Read Full Article 💡 DMK Insight Russian oil firms turning to crypto to dodge sanctions is a game changer for traders. This shift highlights a growing trend where traditional markets are intertwining with digital assets, creating new trading opportunities and risks. For day traders and swing traders, this could lead to increased volatility in both oil and crypto markets as geopolitical tensions rise. Keep an eye on how this affects oil prices and related assets like energy stocks or ETFs, as any significant movement could ripple through the crypto space. If oil prices react sharply, it might also influence Bitcoin and Ethereum, given their status as alternative stores of value. On the flip side, while this could present opportunities, it also raises questions about regulatory responses. If Western nations tighten their grip on crypto exchanges or impose further sanctions, it could lead to a backlash in the crypto market. Watch for any announcements from regulatory bodies, as they could create sudden price swings. For now, traders should monitor oil price levels closely, especially if they approach key resistance or support zones, as this could signal broader market movements. 📮 Takeaway Watch for oil price fluctuations and potential regulatory responses that could impact both oil and crypto markets significantly.

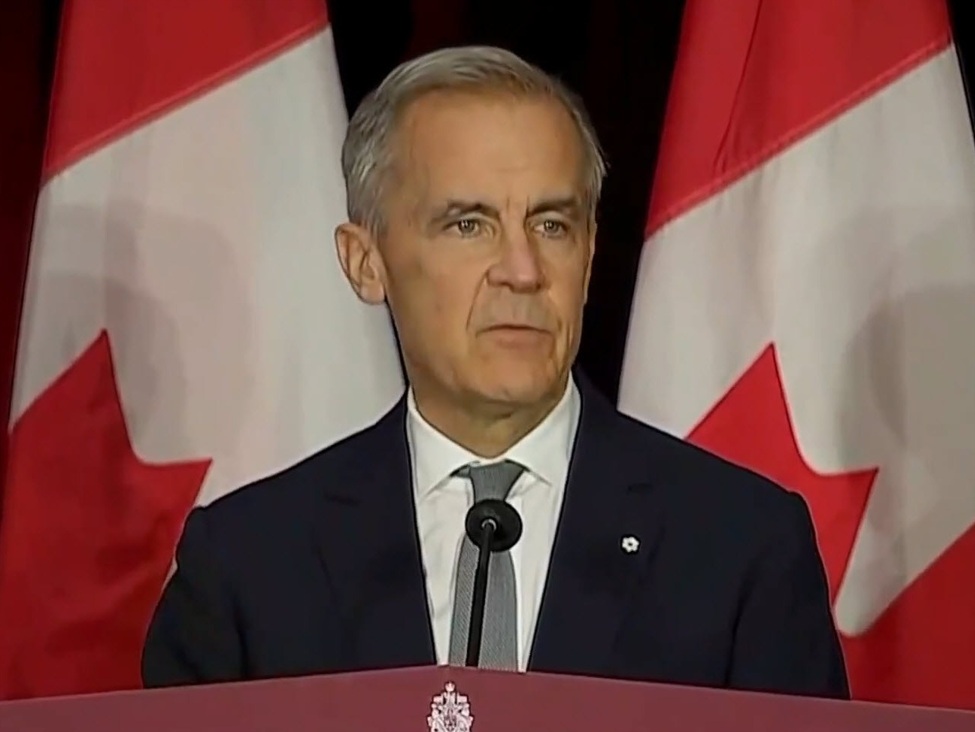

Canada's Carney: The decades-long process of economic integration with the US is over

Canadian Prime Minister Mark Carney is delivering a major speech ahead of his first budget to be The US has fundamentally changed its approach to tradeIt’s not a smooth transition, it’s a ruptureThe decades-long process of economic integration with the US is overOur relationship with the United States will never be the sameNow is not the time to be cautiousCarney reportedly met with opposition leader Pierre Poilivre earlier and described Carney’s proposals as “very reasonable” but called for lower deficits. Estimates for the deficit range from C$50-$100 billion. Canada’s debt is relatively manageable with deficits about half of those in the US vs GDP and total debt to GDP at about 42%.The budget is slated to be delivered November 4 and he said it will be about:BuildingTaking controlWinningCarney said they will be making ‘generational investments’.There is no prosperity without securityPromises largest defense spending in generationsMentions high-speed railOur next tranche of major projects will be announced before Nov 1680% of European steel is manufactured in Europe but only 40% of the steel we use is made hereBudget will include prioritizing Buy Canadian provisions on steel, aluminum and other industriesWe will be our own best customerFederal spending has risen 7% y/y for the past decadeWe will have to do less of some of things we want to doBudget will protect critical programs that allow Canadians get ahead, cites dental careWe will make the national school food program permanent and national childcare programOur economy is holding up but if we don’t act now, these pressure will growWe won’t transform our economy easilyWe will work relentlessly to cut waste and drive efficiencyThe speech has wrapped up but didn’t include much that we don’t already know. We’re getting the contours of an aluminum/steel deal with the US as Canada cuts off foreign imports but gets back access to the US market in exchange. We’ll see if that’s with a 15%, down from 50%, or maybe even less. Otherwise, I think he’s laying the groundwork for running a very large deficit on infrastructure projects but overall these were very familiar themes. This article was written by Adam Button at investinglive.com. 🔗 Read Full Article

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano