Switzerland’s nationwide gambling authority said that user rewards on the platform feature the element of chance, categorizing them as gambling. 🔗 Read Full Article 💡 DMK Insight Switzerland's decision to classify user rewards as gambling is a wake-up call for the crypto and gaming sectors. This move not only reflects a tightening regulatory environment but also raises questions about the sustainability of reward-based models that rely on chance. For investors, this could signal a shift in how platforms operate, potentially leading to increased compliance costs and a reevaluation of user engagement strategies. As the line between gaming and finance blurs, stakeholders must tread carefully or risk losing their footing in a rapidly evolving landscape. 📮 Takeaway Investors should monitor regulatory changes closely, as they could reshape user engagement and platform viability.

Babylon claims breakthrough in using native Bitcoin collateral in DeFi: Finance Redefined

Babylon unveils a proof-of-concept for using native Bitcoin in DeFi lending, as BNB Chain and Hyperliquid post major updates. 🔗 Read Full Article 💡 DMK Insight Babylon's proof-of-concept for integrating native Bitcoin into DeFi lending is a game-changer, potentially bridging the gap between traditional crypto assets and decentralized finance. This move signals a maturation of the DeFi space, where Bitcoin, often seen as a digital gold, could finally earn its place as a utility asset. As BNB Chain and Hyperliquid also roll out significant updates, it’s clear that innovation is heating up in the crypto arena, making it an exciting time for investors looking to diversify their portfolios. Just remember, with great power comes great responsibility—especially in the wild west of DeFi. 📮 Takeaway Keep an eye on Bitcoin's role in DeFi; it could reshape lending dynamics.

Swiss regulator GESPA takes aim at FIFA’s NFT platform in formal complaint

Switzerland’s nationwide gambling authority said that user rewards on the platform feature the element of chance, categorizing them as gambling. 🔗 Read Full Article 💡 DMK Insight Switzerland's decision to classify user rewards as gambling underscores the fine line between gaming and investing in the crypto space. This move could signal a tightening regulatory environment, prompting platforms to rethink their reward structures. For investors, it’s a reminder that the thrill of chance can quickly turn into a legal quagmire, potentially impacting user engagement and platform viability. As the lines blur, staying informed on regulatory shifts becomes not just prudent, but essential. 📮 Takeaway Investors should monitor regulatory changes closely, as they could reshape the landscape of user rewards.

This thing is broken

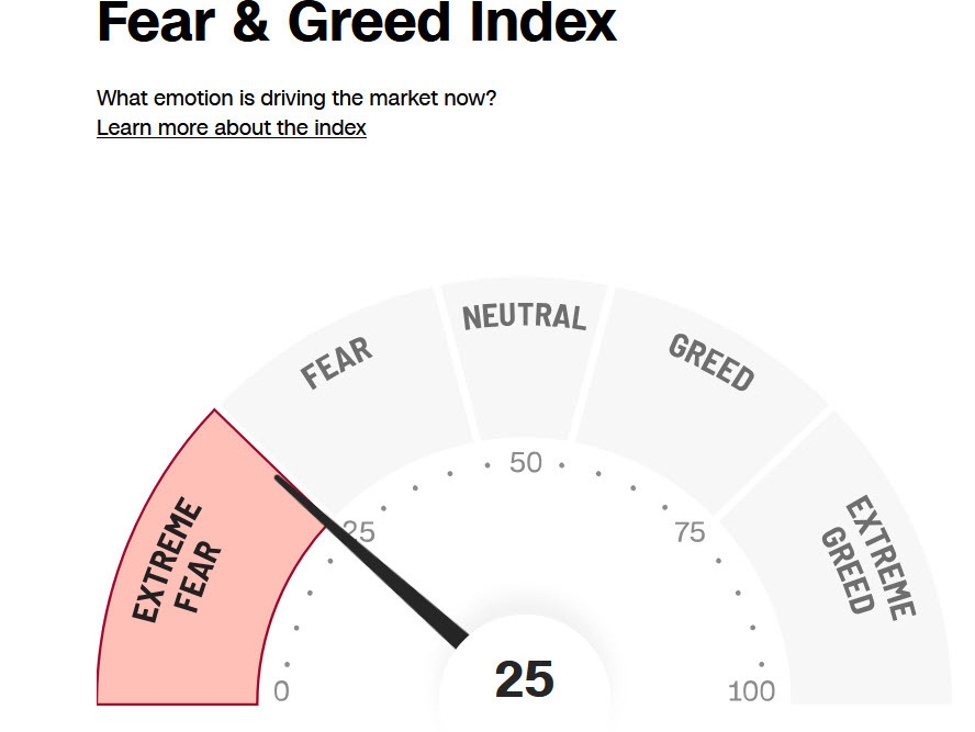

At times, the Fear & Greed index is a somewhat-useful indicator of market sentiment, particularly at extremes. But somehow it’s showing ‘extreme fear’ at the moment despite the S&P 500 being just 1.8% off the all-time high set just last week.On the face of it, that should be a strong buy signal for stock markets. What it’s picking up on is terrible breadth in the stock market, a swing in the put-call ratio, the FIX at 23.7, falling Treasury yields and junk bond demand. The problem is that these numbers are stochastic and we’re coming off a period of euphoric returns so they’re benchmarked against an impossible metric. This article was written by Adam Button at investinglive.com. 🔗 Read Full Article 💡 DMK Insight The current 'extreme fear' reading from the Fear & Greed index, juxtaposed with the S&P 500's near-record highs, reveals a fascinating paradox in market psychology. Investors seem to be wrestling with uncertainty, perhaps haunted by past downturns or geopolitical tensions, even as the market dances on the edge of euphoria. This dissonance suggests that while the numbers may look rosy, the underlying sentiment is anything but stable. For traders, this could signal a ripe opportunity to gauge when to capitalize on fear or when to tread cautiously. 📮 Takeaway Watch for shifts in sentiment; extreme fear could indicate a buying opportunity or a warning sign.

Hopefully we get some weekend details from the Bessent-He call today

A report earlier today indicated that Treasury Secretary Scott Bessent will speak by phone today with Chinese Vice Premier He Lifeng to discuss the ongoing trade negotiations. It’s not clear what time that was scheduled for as it would have had to been early this morning Washington time or late this evening, in order for the time zones to align.The high-level talks are a good sign that there is at least a will to make progress and de-escalate. Trump today said “I think we’re going to do fine with China.”I’d assume the market is anticipating some positive developments on the weekend but we never priced in any real trouble either, given that Trump TACO’d on the weekend. This article was written by Adam Button at investinglive.com. 🔗 Read Full Article 💡 DMK Insight The phone call between Treasury Secretary Scott Bessent and Chinese Vice Premier He Lifeng underscores the delicate dance of diplomacy that continues to shape global markets. As trade negotiations linger, investors are left on the edge of their seats, wondering if this conversation will yield any concrete outcomes or simply more rhetoric. The stakes are high; a breakthrough could signal a thaw in relations, while a stalemate might send markets reeling. In a world where every word can sway the financial tide, this call is more than just a chat—it's a potential turning point. 📮 Takeaway Keep an eye on trade talks; they could shift market sentiment dramatically.

Trump: I think Putin wants to end the war

Things coming along pretty wellZelensky also said that he’s confident with US help he can stop the war and that it’s most important for Ukrainians to have security guarantees. Some times these things can happen quickly. The battlefield has stagnated and the costs are high. Maybe this really is the end? If so, I’d imagine the euro and European stocks are one of the cleanest trades and I wouldn’t want to be long oil. This article was written by Adam Button at investinglive.com. 🔗 Read Full Article 💡 DMK Insight Zelensky's confidence in U.S. support underscores a pivotal moment for Ukraine, where the stakes are not just territorial but existential. As the battlefield stagnates, the pressure mounts for decisive action — both militarily and diplomatically. This situation serves as a reminder that in geopolitics, the balance of power can shift as quickly as a market correction, and investors should keep a keen eye on developments that could affect regional stability and economic forecasts. 📮 Takeaway Monitor geopolitical developments closely; they can impact market sentiment and investment strategies significantly.

Gold's Record Frenzy Spurs Tokenized Gold’s $1B Daily Volume

Investors are increasingly tapping gold-backed crypto tokens for active trading and hedging, a CEX.io report said. 🔗 Read Full Article 💡 DMK Insight As the market wobbles, it seems investors are turning to gold-backed crypto tokens like a lifebuoy in a turbulent sea. This shift signals a growing desire for stability in an otherwise volatile landscape, where traditional assets and digital currencies often dance a precarious tango. By blending the age-old allure of gold with the modern convenience of crypto, traders are not just hedging their bets; they're crafting a safety net that could redefine asset management in uncertain times. 📮 Takeaway Keep an eye on gold-backed tokens as a potential hedge against market volatility.

Huobi Founder Li Lin to Lead $1B Ether Treasury Firm: Bloomberg

Li Lin’s Avenir Capital is said to be teaming up with Asia’s crypto pioneers to build a regulated vehicle focused on ether accumulation. 🔗 Read Full Article 💡 DMK Insight Avenir Capital's collaboration with Asia's crypto trailblazers signals a strategic pivot towards regulatory compliance in the often-chaotic world of crypto. By focusing on ether accumulation, they are not just betting on the asset's potential but also on the growing acceptance of digital currencies in mainstream finance. This move could set a precedent for other investment firms, highlighting the importance of navigating regulatory waters while still capitalizing on the crypto wave. As the landscape evolves, those who adapt will likely find themselves ahead of the curve. 📮 Takeaway Watch for regulatory developments as they could shape ether's market dynamics significantly.

How to catch market manipulation in altcoins before they crash

Crypto market manipulation involves organized efforts to artificially move altcoin prices and mislead traders about their true value. 🔗 Read Full Article 💡 DMK Insight Market manipulation in the crypto space is a serious concern, as it undermines the integrity of trading and can lead to significant losses for unsuspecting investors. When organized groups conspire to inflate or deflate altcoin prices, they create a deceptive environment that can mislead even the most seasoned traders. This not only distorts market signals but also erodes trust in the entire ecosystem. As the crypto market matures, understanding these manipulative tactics becomes essential for anyone looking to navigate this volatile landscape. 📮 Takeaway Stay vigilant and educate yourself about market manipulation tactics to protect your investments. 💡 DMK Insight Market manipulation in the crypto realm is not just a nuisance; it's a ticking time bomb for investors. When organized groups conspire to inflate altcoin prices, they create a mirage that can lure in even the savviest traders. The fallout can be devastating, leading to a loss of trust and capital. As the crypto landscape evolves, understanding these tactics becomes crucial for anyone looking to navigate this volatile market safely. 📮 Takeaway Stay vigilant and research altcoin fundamentals to avoid falling for price manipulation traps.

Is Smart Money Exiting? Whales Dump Solana, Aave, and Aster

A broad altcoin sell-off is seeing whales de-risking, according to analysts, citing fears of a black swan event. 🔗 Read Full Article 💡 DMK Insight The recent altcoin sell-off highlights a growing unease among investors, particularly the whales who typically lead market trends. Their decision to de-risk suggests they are bracing for potential turbulence, which could indicate a broader market correction on the horizon. This behavior often signals to smaller investors that caution is warranted, as the actions of these large holders can significantly influence price movements. As the market grapples with uncertainty, it’s a reminder that even the most stable assets can be vulnerable to sudden shifts. 📮 Takeaway Keep an eye on whale movements; they often foreshadow market trends. 💡 DMK Insight The recent altcoin sell-off is a clear signal that even the most seasoned investors are feeling the jitters. When whales start to de-risk, it often indicates a looming concern that could ripple through the market. This behavior suggests that they might be anticipating a black swan event, which could lead to further volatility. For traders, this is a crucial moment to reassess risk exposure and market positions, as the actions of these large holders can set the tone for broader market sentiment. 📮 Takeaway Keep an eye on whale movements; they often signal shifts in market sentiment.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Solana

Solana  JUSD

JUSD  TRON

TRON  Lido Staked Ether

Lido Staked Ether