ECB inflation forecasts were mostly unchanged in today’s update.2025 HICP seen at 2.1% vs. 2% prior2026 at 1.7% vs. 1.6% prior2027 at 1.9% vs. 2.0% priorFor the relevant period, that’s all essentially meeting the mandate. The market may see that lower 2027 number as paving the way for another cut, though market pricing through year end is still at 40%, which is the same as before the decision.The market also doesn’t appear to be impressed by the 2025 GDP growth forecast at 1.2% vs. 0.9% prior.2026 at 1.0% vs. 1.1% prior;2027 at 1.3% vs. 1.3% priorThe euro move so far is about 15 pips to the downside, which is largely inconsequential. We will wait for Lagarde’s press conference. This article was written by Adam Button at investinglive.com. Source: investinglive.com (Read Full Article)

US August CPI 2.9% y/y vs 2.9% expected

Headline CPI:CPI at 2.9% is the highest since JanuaryPrior was +2.7m/m reading at +0.4% vs +0.3% expected (unrounded consensus was +0.36%)Month-over-month unrounded % vs +0.287% priorThe rest of the numbers are largely in line.Core CPI:Core CPI +3.1% vs +3.1% expectedCore CPI m/m +0.3% vs +0.3% expected (some forecasts were +0.27%)Core unrounded +0.346% vs +0.228% m/m prior (almost rounded to +0.4%)Real weekly earnings -0.1% vs +0.4% prior (revised to +0.1%)Core goods prices +0.3% vs +0.2% prior Core services +0.3% vs +0.4% prior Core services ex shelter +0.2% vs +0.3% prior Core-CPI services ex-rent/OER +0.2% vs +0.3% prior Services ex energy +0.3% vs +0.4% prior Owners equivalent rent +0.4% vs +0.3% priorThe core unrounded number gives this report a touch of a hawkish bent and that likely kills the chance of a 50 basis point cut. I suspect the market was also leaning dovish after yesterday’s lower PPI. However if we go further out the curve, the market has priced in about 10 more basis points cuts in easing through 2026, likely to a spike in initial jobless claims today.In the past three months, there is a pace of inflation that will make it very tough to get below target, and that’s in a period when oil prices have been falling. This article was written by Adam Button at investinglive.com. Source: investinglive.com (Read Full Article)

US initial jobless claims 263K versus 235K estimate

Prior week 237KInitial jobs claims 263K vs 235K estimate. Prior week revised marginally lower to 236K vs 237K priorContinuing claims 1.939M vs 1.951M estimate. Prior week 1.939M revised from 1.940M4-week moving average of initial jobless claims 240.50K vs 230.75KFor the continuing claims:4-week moving average of continuing claims: 1,945,750Change from prior week: −750Previous week’s revised average: 1,946,500 (revised down by 250 from 1,946,750)The number is the highest since October 2021.The initial jobs claims is the surprise. Did it have to do with the Labor Day holiday. US stocks have given up some of their gains after the CPI/claims data. The S&P and NASDAQ indices are implying a gain of 6 point and 51 points respectively. Any again today would still be a record.The US dollar has moved lower as yields have also moved lower. The 2-year yield is now down -4.5 basis point at 3.489%. The 10 year yield is down -2.5 basis points at 4.007%.The EURUSD moved back above its 200-hour moving average at 1.1693, and tested the 100-hour moving average at 1.17211 where sellers leaned. The bias is more neutral between the two moving averages. ECB’s Legarde press conference is ahead This article was written by Greg Michalowski at investinglive.com. Source: investinglive.com (Read Full Article)

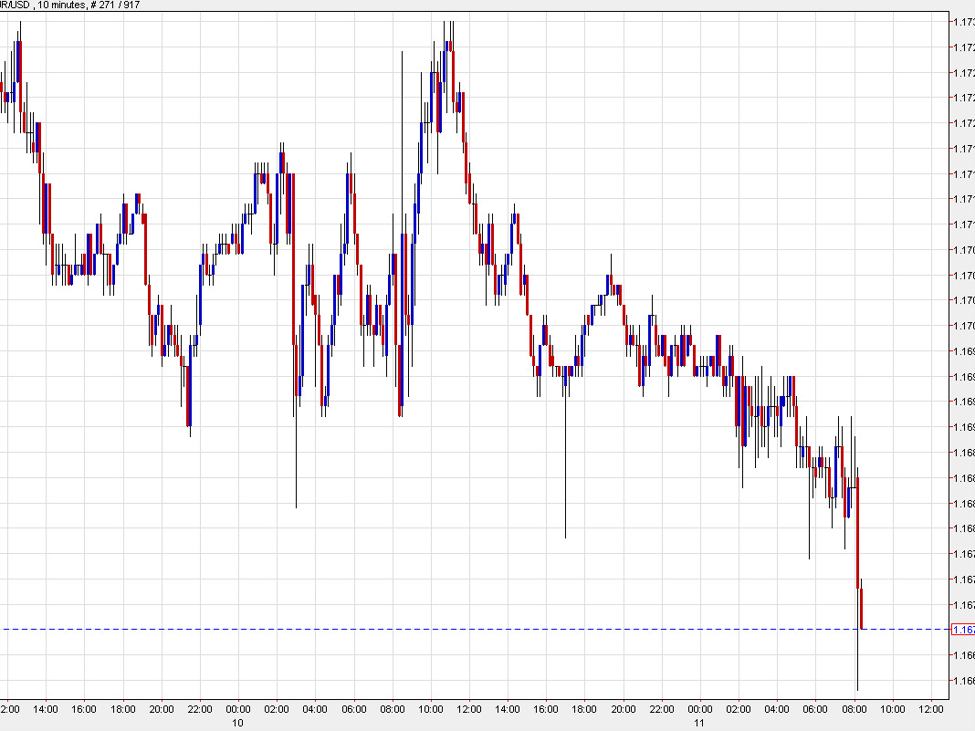

EURUSD moves down and up after rate decision and US data

The EURUSD has been whipsawed in the wake of the ECB rate decision and a stronger-than-expected initial jobless claims report. The first reaction came on the downside, with sellers pressing the pair toward the 61.8% retracement of the move down from the July 1 high, a key level at 1.16615. Buyers held the line there, sparking a rebound.That rebound gained traction after the U.S. data, lifting the pair back above the 200-hour moving average at 1.1693 and up to test the 100-hour moving average at 1.1721. Sellers, however, defended that first look against the 100-hour average, halting the upside momentum and forcing the price back toward the 200-hour MA.With the pair now caught between the 100-hour and 200-hour moving averages, the market is once again sitting in neutral territory. Traders will look to a break on either side of these bias-defining moving averages to set the next directional move.Lagarde’s press conference could bring additional volatility as the market channels between EU and US fundamentals. This article was written by Greg Michalowski at investinglive.com. Source: investinglive.com (Read Full Article)

Lagarde press conference: Headwinds on growth should fade next year

Higher tariffs, stronger euro and competition are holding growth backInvestment should be underpinned by government spendingRecent surveys point to growth both in the manufacturing and services sectorsGrowth shows resilience of domestic demandEconomic risks more balanced (previously were tilted to the downside)Inflation outlook is more uncertain that usual (no hint on upside or downside risks)Stronger euro could bring inflation down more than expectedShe is upbeat so far.The bolded comment led to immediate bids in the euro.More:The disinflationary process is overWe are still in a good placeInflation is where we want it to be, the domestic market is showing resilienceDecision was unanimousTrade uncertainty has diminishedMinimal deviation from target will not necessarily justify movement This article was written by Adam Button at investinglive.com. Source: investinglive.com (Read Full Article)

USDCHF falls to the 100 hour MA after the US jobless claims

Yesterday at this time, the technical bias tilt was to the downside (see post HERE) with the price below the 100-hour moving average. However, the price rebounded in the session and was able to extend back above that moving average by the close.Today, the USDCHF pair initially pushed higher and the early U.S. session, the price broke above the 200-hour moving average at 0.8001. That move came in tandem with the EURUSD’s drop following the initial reaction to the ECB policy announcement.However, the rally was short-lived. A sharp spike in U.S. initial jobless claims to 263K vs. 235K expected quickly flipped the script. Sellers stepped in, driving the pair back down toward the falling 100-hour moving average at 0.7967. This time, on the first test, support buyers leaned against the level, giving the pair leading to a modest bounce.At the moment, the pair is trading near 0.7973. The short-term bias has tilted slightly to the downside after the failed break above the 200-hour MA and the subsequent fall back below the 38.2% retracement of the move lower from last week’s high. That level comes in at 0.7975.That said, the 100-hour MA at 0.7967 remains the key risk-defining level. If price holds above it, buyers may continue to defend and look for a rebound toward the topside. A sustained move below, however, would open the door for a deeper correction lower.Overall, the buyers had their shot. They failed. The sellers are taking their shot. Will they be able to push below the 100-hour moving average, or is the battle between 100 and 200-hour moving averages what traders are focused on?Fundamentally, earlier this week SNBs Schlegel commented on policy going forward saying:Negative interest rates would only return under exceptional circumstances, stressing their harmful effects on savers and pension funds. With the policy rate now at zero following this year’s cuts, Schlegel said officials remain cautious about further easing, even as they monitor U.S. tariffs and sluggish domestic inflation. He defended the pace of earlier reductions as necessary to avoid bigger risks, but conceded it leaves the SNB with limited scope to respond to new shocks. Markets, he noted, still expect rates to remain steady well into 2026.That should be supportive for the CHF, but it takes two to tango in a currency pair and technicals do matter too. The Fed is expected to cut rates in September, starting their easing cycle. This article was written by Greg Michalowski at investinglive.com. Source: investinglive.com (Read Full Article)

Odds of a further ECB rate cut next year fall to 50%

It’s a coin flip on whether the ECB easing cycle is over.Market pricing for mid-2026 before the ECB press conference was at about 60% but it’s drifted down to just below 50% after Lagarde took a upbeat tone around growth. The July 2026 meeting is most likely for another cut at the moment with 12.2 bps of easing priced in. For the remainder of this year, the odds of a cut fell to 24% from 40% pre-decision.With that the euro also climbed about 45 pips from pre-ECB levels. It initially fell but quickly recovered and climbed when Lagarde shifted the balance of growth risks to neutral from negative. This article was written by Adam Button at investinglive.com. Source: investinglive.com (Read Full Article)

Major US stock indices trade higher to kick off the new trading day

The US economic data today showed weakness in the employment (initial jobs claims 263K versus 235K estimate), and higher CPI. However, the upside surprise was largely driven by housing costs rather than tariffs. Rent rose 0.34% month-over-month, the fastest pace since December 2024, while shelter costs climbed 0.39% month-over-month, the biggest increase since January 2025. Both components remain sticky drivers of inflation, though real-time indicators suggest that housing prices are already softening. As a result, analysts expect rent and shelter inflation to ease in the coming months as official measures catch up with current market trends.The US stock market is reacting to the expectations that the Fed will indeed cut next week (and cut further going forward), and the AI tailwind. Yields in the US also declined with the 10-year briefly fallen below the 4.00% level for the 1st time since April 7.With the broader S&P and NASDAQ indices higher, and each closing at record levels yesterday, any positive close today would of course be a new record.A snapshot of the levels currently shows:Dow industrial average rose 201 points or 0.44% have 45691.S&P index up 16.21 points or 0.24% at 6547.6.NASDAQ index up 32 points or 0.17% had to 192.93Having said that, there is some profit taking some of the big winners from yesterday. Oracle shares are currently trading down -2.97%, while Broadcom is down month 1.31% and AMD shares are down -1.34%. Shares of Nvidia are up modestly by 0.38%..Some winners today include:Micron (MU): +10.79%. Citi analyst Christopher Danely raised his price target on the memory chip maker to $175 from $150 while maintaining a Buy rating.Synopsys (SNPS): +7.53%Lam Research (LRCX): +4.66%Stellantis NV (STLA): +4.46%Rivian Automotive (RIVN): +3.92%Alibaba ADR (BABA): +3.06%ARK Genomic Revolution (ARKG): +2.70%Moderna (MRNA): +2.59%Western Digital (WDC): +2.47%Celsius (CELH): +2.20%Chewy (CHWY): +2.22%General Mills (GIS): +1.88% And some of the losers today include:Oracle (ORCL): -2.97%Broadcom (AVGO): -1.31%AMD (AMD): -1.34%Delta Air Lines (DAL): -1.17%Super Micro Computer (SMCI): -0.73%Alphabet A (GOOGL): -0.60%ProShares UltraPro Short QQQ (SQQQ): -0.71%American Airlines (AAL): -0.47%Netflix (NFLX): -0.57%United Airlines Holdings (UAL): -0.57%Palantir (PLTR): -0.46%SPDR Gold Shares (GLD): -0.49%Boston Scientific (BSX): -0.52% This article was written by Greg Michalowski at investinglive.com. Source: investinglive.com (Read Full Article)

S&P 500 hits intraday record high, aided by financials

A broad array of gains in non-tech equities helped lift the S&P 500 to a record high today, in a sign of wider buying and less concentration in tech. The S&P 500 rose 37 points to an all-time high of 6572 a short time ago.Topping the list are:MUABBVGSCATMMMMSLOWHDWMTGMMany of these are names that will benefit from rate cuts and that’s likely a reaction to a poor initial jobless claims report today and hopes that the Fed will be more-aggressive with rate cuts.A long laggard is NFLX, down 2% after its chief product officer (the guy who really embraced reality TV and low-brow entertainment) left the company.Deutche Bank today raised its year-end target for the S&P 500 to 7000 and I find it hard to argue with them. This article was written by Adam Button at investinglive.com. Source: investinglive.com (Read Full Article)

EURUSD trades higher as markets react to the Lagarde hawkish/less dovish tilt

The EURUSD is pushing higher on the back of a more hawkish/less dovish tilt from ECB President Lagarde and a drop in U.S. yields, with the 10-year falling below 4% for the first time since April 7. Lagarde commented that the disinflationary process is over and that trade uncertainty has diminished.On the technical front, the pair has moved back above the 100-hour moving average at 1.1722. The first test of that level earlier in the session drew sellers (see earlier post), but the pullback was shallow. Momentum then built as Lagarde’s comments combined with the slide in yields gave buyers the upper hand.The price is now testing a key resistance zone between 1.1730 and 1.1742, the ceiling from August. The latest push briefly stretched to 1.17435, nudging above the top of that area. A sustained break above will shift focus to the Tuesday high near 1.1779, followed by the July 24 peak at 1.1788, and then the July 1 high at 1.18292—the highest level since September 2021 (see daily chart below).For now, traders will be watching whether the pair can hold above the 1.1730–1.1742 zone to confirm a bullish breakout. This article was written by Greg Michalowski at investinglive.com. Source: investinglive.com (Read Full Article)

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  USDC

USDC  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano